Hasbro 2008 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2008 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

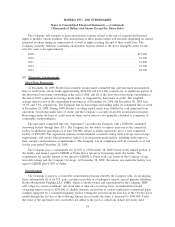

debentures may also put the notes back to Hasbro in December 2011 and December 2016. At these times, the

purchase price may be paid in cash, shares of common stock or a combination of the two, at the discretion of

the Company.

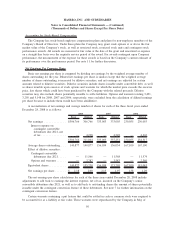

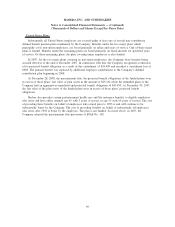

(8) Income Taxes

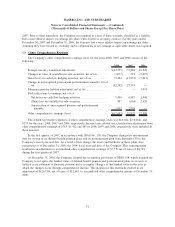

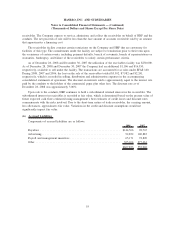

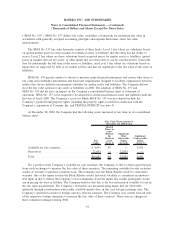

Income taxes attributable to earnings before income taxes are:

2008 2007 2006

Current

United States ...................................... $ 68,514 42,613 40,875

State and local ..................................... 251 5,497 3,203

International....................................... 40,530 43,691 42,374

109,295 91,801 86,452

Deferred

United States ...................................... 22,917 33,707 24,912

State and local ..................................... 1,964 2,889 2,135

International....................................... 113 982 (2,080)

24,994 37,578 24,967

$134,289 129,379 111,419

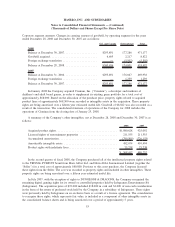

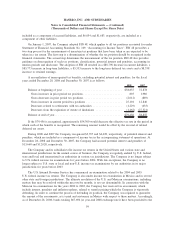

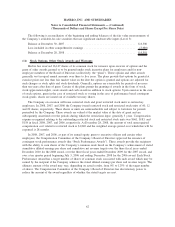

Certain income tax (benefits) expenses, not reflected in income taxes in the statements of operations

totaled $(29,287) in 2008, $2,542 in 2007, and $(27,876) in 2006. These income tax (benefits) expenses relate

primarily to pension amounts recorded in AOCE and stock options. In 2008, 2007, and 2006, the deferred tax

portion of the total (benefit) expense was $(26,555), $20,163, and $(12,917), respectively.

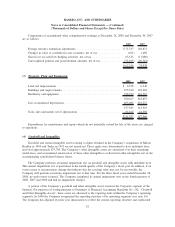

A reconciliation of the statutory United States federal income tax rate to Hasbro’s effective income tax

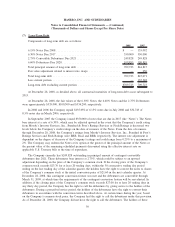

rate is as follows:

2008 2007 2006

Statutory income tax rate ....................................... 35.0% 35.0% 35.0%

State and local income taxes, net .................................. 1.0 1.1 1.2

Investment of foreign earnings in U.S. . . ............................ 3.5 4.4 —

Tax on international earnings .................................... (7.9) (10.9) (9.7)

Fair value adjustment of liabilities potentially settleable in common stock . . . — 3.4 3.3

Change in valuation allowance ................................... — — 0.8

Exam settlements and statute expirations ............................ (0.8) (6.5) 1.5

Other, net ................................................... (0.4) 1.5 0.5

30.4% 28.0% 32.6%

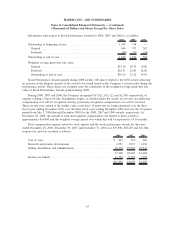

During 2008 and 2007, the Company designated $60,000 and $90,000 of the respective current year

international net earnings that will not be indefinitely reinvested outside of the U.S. The incremental income

tax on this amount, representing the difference between the U.S. federal income tax rate and the income tax

rates in the applicable international jurisdictions, is a component of deferred income tax expense.

57

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)