Hasbro 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

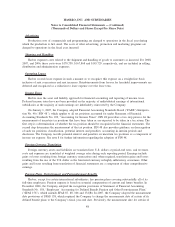

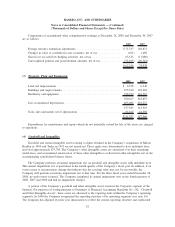

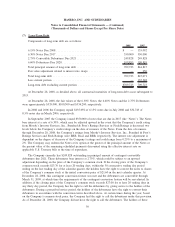

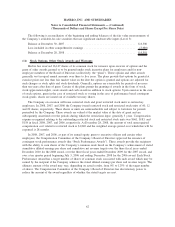

The components of earnings before income taxes, determined by tax jurisdiction, are as follows:

2008 2007 2006

United States ........................................ $208,125 165,274 113,761

International ........................................ 232,930 297,108 227,713

$441,055 462,382 341,474

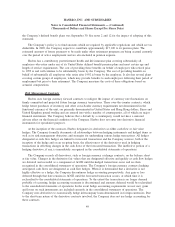

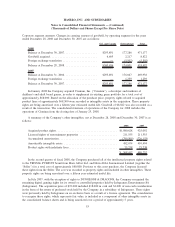

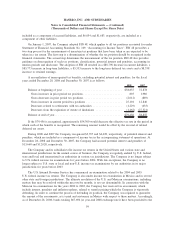

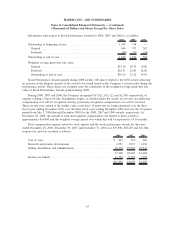

The components of deferred income tax expense arise from various temporary differences and relate to

items included in the statements of operations. The tax effects of temporary differences that give rise to

significant portions of the deferred tax assets and liabilities at December 28, 2008 and December 30, 2007 are:

2008 2007

Deferred tax assets:

Accounts receivable.......................................... $ 16,764 20,524

Inventories ................................................ 20,226 24,608

Losses and tax credit carryforwards .............................. 34,438 39,094

Operating expenses .......................................... 42,947 42,759

Pension ................................................... 34,065 9,990

Other compensation .......................................... 31,331 24,477

Postretirement benefits........................................ 12,647 13,507

Other .................................................... 39,147 37,274

Gross deferred tax assets .................................... 231,565 212,233

Valuation allowance.......................................... (11,755) (36,254)

Net deferred tax assets ...................................... 219,810 175,979

Deferred tax liabilities:

Convertible debentures ....................................... 47,608 40,185

International earnings not indefinitely reinvested .................... 24,641 20,422

Depreciation and amortization of long-lived assets ................... 40,509 15,833

Other .................................................... 11,035 2,408

Deferred tax liabilities ...................................... 123,793 78,848

Net deferred income taxes ....................................... $ 96,017 97,131

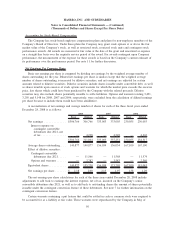

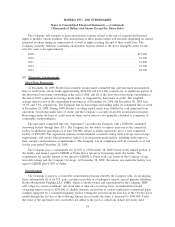

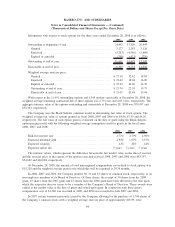

Hasbro has a valuation allowance for deferred tax assets at December 28, 2008 of $11,755, which is a

decrease of $24,499 from $36,254 at December 30, 2007. The valuation allowance pertains to United States

and International loss carryforwards, some of which have no expiration and others that would expire beginning

in 2009. The decrease in the valuation allowance is primarily attributable to the generation of sufficient capital

gains in 2008 to utilize prior year capital losses.

Based on Hasbro’s history of taxable income and the anticipation of sufficient taxable income in years

when the temporary differences are expected to become tax deductions, the Company believes that it will

realize the benefit of the deferred tax assets, net of the existing valuation allowance.

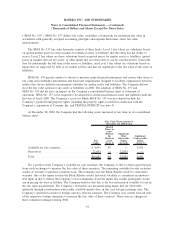

Deferred income taxes of $53,285 and $53,040 at the end of 2008 and 2007, respectively, are included as

a component of prepaid expenses and other current assets, and $53,031 and $45,855, respectively, are included

as a component of other assets. At the same dates, deferred income taxes of $4,245 and $81, respectively, are

58

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)