Hasbro 2008 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2008 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Accounting for Stock-Based Compensation

The Company has stock-based employee compensation plans and plans for non-employee members of the

Company’s Board of Directors. Under these plans the Company may grant stock options at or above the fair

market value of the Company’s stock, as well as restricted stock, restricted stock units and contingent stock

performance awards. All awards are measured at fair value at the date of the grant and amortized as expense

on a straight-line basis over the requisite service period of the award. For awards contingent upon Company

performance, the measurement of the expense for these awards is based on the Company’s current estimate of

its performance over the performance period. See note 11 for further discussion.

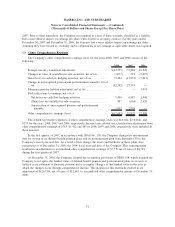

Net Earnings Per Common Share

Basic net earnings per share is computed by dividing net earnings by the weighted average number of

shares outstanding for the year. Diluted net earnings per share is similar except that the weighted average

number of shares outstanding is increased by dilutive securities, and net earnings are adjusted for certain

amounts related to dilutive securities. Dilutive securities include shares issuable under convertible debt, as well

as shares issuable upon exercise of stock options and warrants for which the market price exceeds the exercise

price, less shares which could have been purchased by the Company with the related proceeds. Dilutive

securities may also include shares potentially issuable to settle liabilities. Options and warrants totaling 3,491,

3,250 and 5,148 for 2008, 2007 and 2006, respectively, were excluded from the calculation of diluted earnings

per share because to include them would have been antidilutive.

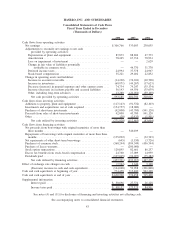

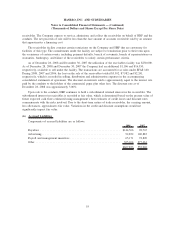

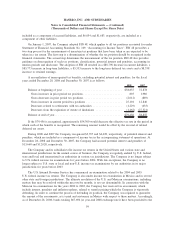

A reconciliation of net earnings and average number of shares for each of the three fiscal years ended

December 28, 2008 is as follows:

Basic Diluted Basic Diluted Basic Diluted

2008 2007 2006

Net earnings .............. $306,766 306,766 333,003 333,003 230,055 230,055

Interest expense on

contingent convertible

debentures due 2021, net

oftax................ — 4,238 — 4,248 — 4,262

$306,766 311,004 333,003 337,251 230,055 234,317

Average shares outstanding.... 140,877 140,877 156,054 156,054 167,100 167,100

Effect of dilutive securities:

Contingent convertible

debentures due 2021 ..... — 11,566 — 11,568 — 11,574

Options and warrants ...... — 2,787 — 3,583 — 2,369

Equivalent shares ........... 140,877 155,230 156,054 171,205 167,100 181,043

Net earnings per share ....... $ 2.18 2.00 2.13 1.97 1.38 1.29

The net earnings per share calculations for each of the three years ended December 28, 2008 include

adjustments to add back to earnings the interest expense, net of tax, incurred on the Company’s senior

convertible debentures due 2021, as well as to add back to outstanding shares the amount of shares potentially

issuable under the contingent conversion feature of these debentures. See note 7 for further information on the

contingent conversion feature.

Certain warrants containing a put feature that could be settled in cash or common stock were required to

be accounted for as a liability at fair value. These warrants were repurchased by the Company in May of

50

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)