Hasbro 2008 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2008 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

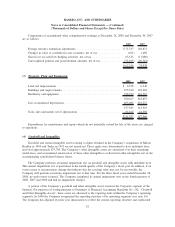

receivables. The Company expects to service, administer, and collect the receivables on behalf of HRF and the

conduits. The net proceeds of sale will be less than the face amount of accounts receivable sold by an amount

that approximates a financing cost.

The receivables facility contains certain restrictions on the Company and HRF that are customary for

facilities of this type. The commitments under the facility are subject to termination prior to their term upon

the occurrence of certain events, including payment defaults, breach of covenants, breach of representations or

warranties, bankruptcy, and failure of the receivables to satisfy certain performance criteria.

As of December 28, 2008 and December 30, 2007 the utilization of the receivables facility was $250,000.

As of December 28, 2008 and December 30, 2007 the Company had an additional $1,106 and $16,550,

respectively, available to sell under the facility. The transactions are accounted for as sales under SFAS 140.

During 2008, 2007 and 2006, the loss on the sale of the receivables totaled $5,302, $7,982 and $2,241,

respectively, which is recorded in selling, distribution and administration expenses in the accompanying

consolidated statements of operations. The discount on interests sold is approximately equal to the interest rate

paid by the conduits to the holders of the commercial paper plus other fees. The discount rate as of

December 28, 2008 was approximately 3.00%.

Upon sale to the conduits, HRF continues to hold a subordinated retained interest in the receivables. The

subordinated interest in receivables is recorded at fair value, which is determined based on the present value of

future expected cash flows estimated using management’s best estimates of credit losses and discount rates

commensurate with the risks involved. Due to the short-term nature of trade receivables, the carrying amount,

less allowances, approximates fair value. Variations in the credit and discount assumptions would not

significantly impact fair value.

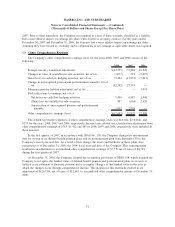

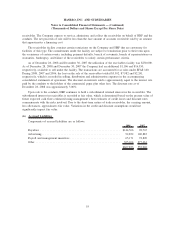

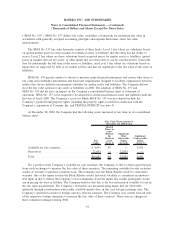

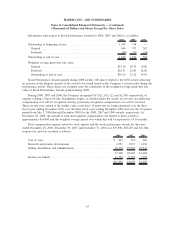

(6) Accrued Liabilities

Components of accrued liabilities are as follows:

2008 2007

Royalties ................................................... $144,566 98,767

Advertising .................................................. 92,852 100,883

Payroll and management incentives ................................ 65,171 78,809

Other ...................................................... 305,264 277,461

$607,853 555,920

55

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)