Hasbro 2008 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2008 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

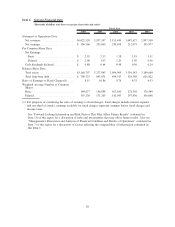

general inflationary increases. The decrease as a percentage of revenues in 2008 and 2007 compared to 2006

reflects the fixed nature of certain of these expenses, coupled with the higher revenues in each of those years.

Interest Expense

Interest expense increased to $47,143 in 2008 from $34,618 in 2007. The increase in interest expense was

primarily the result of higher average borrowings in 2008 primarily as a result of the issuance of $350,000 of

notes in September 2007, partially offset by the repayment of $135,092 of notes in July 2008. The increase in

the average borrowing rate for 2008 from the issuance of long-term debt in 2007 was more than offset by

decreases in the average borrowing rate on short-term debt in 2008 as well as the repayment of 6.15% notes in

July 2008.

Interest expense increased to $34,618 in 2007 from $27,521 in 2006. The increase in interest expense was

due to higher average borrowings in 2007 primarily resulting from the issuance of $350,000 of notes in

September 2007. The majority of the proceeds from the issuance of these notes were used to repay short-term

debt resulting from increased repurchases of common stock as well as the repurchase of the Lucas warrants

for $200,000.

Interest Income

Interest income was $17,654 in 2008 compared to $29,973 in 2007 and $27,609 in 2006. The decrease in

interest income in 2008 from 2007 is primarily the result of lower returns on invested cash. Interest income in

2006 includes $5,200 related to a long-term deposit that was refunded during 2006. The increase in interest

income in 2007 from 2006 primarily reflected higher average rates of return in 2007 compared to 2006, and,

to a lesser extent, higher average invested balances in 2007. During a portion of 2007 and 2006, the Company

invested excess cash in auction rate securities, which generated a higher rate of return and contributed to the

higher level of interest income in 2007 and 2006.

Other (Income) Expense, Net

Other (income) expense, net of $23,752 in 2008 compares to $52,323 in 2007 and $34,977 in 2006. In

2007 and 2006 the major component of other (income) expense was non-cash expense related to the change in

fair value of the Lucas warrants, which were required to be classified as a liability. These warrants were

required to be adjusted to their fair value each quarter through earnings. In May 2007, the Company exercised

the call option on these warrants and repurchased them for $200,000 in cash, which approximated fair value at

that date. As these warrants were repurchased in 2007, there was no fair value adjustment in 2008. For 2007

and 2006, expense related to the change in fair value of these warrants was $44,370 and $31,770, respectively.

Absent the impact of the fair value adjustments, increased expense in 2008 primarily relates to increased

foreign exchange losses arising from the impact of the large downward movement in foreign exchange rates,

primarily in the fourth quarter of 2008, on non-U.S. denominated intercompany balances.

Income Taxes

Income tax expense totaled 30.4% of pretax earnings in 2008 compared with 28.0% in 2007 and 32.6%

in 2006. Income tax expense for 2008 is net of a tax benefit of approximately $10,200 related to discrete tax

events, primarily comprised of a benefit from the repatriation of certain foreign earnings, as well as the

settlement of various tax examinations in multiple jurisdictions. Income tax expense for 2007 was net of a

benefit of $29,999 related to discrete tax events, primarily relating to the recognition of previously

unrecognized tax benefits. Income tax expense for 2006 includes a charge of approximately $7,800 related to

discrete tax events, primarily relating to the settlement of various tax examinations in multiple jurisdictions.

Absent these items, potential interest and penalties recorded in 2008 and 2007 related to uncertain tax

positions, and the effect of the fair value adjustment of the Lucas warrants, which had no tax effect in 2007

and 2006, the 2008 effective tax rate would have been 32.8% compared to 30.5% in 2007 and 27.6% in 2006.

The increase in the adjusted rate to 32.8% in 2008 compared to 30.5% in 2007 primarily reflects the change

in the mix of where the Company earned its profits. The increase in the adjusted rate to 30.5% in 2007 from

28