Hasbro 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(“SFAS No. 159”). SFAS No. 157 defines fair value, establishes a framework for measuring fair value in

accordance with generally accepted accounting principles and expands disclosures about fair value

measurements.

The SFAS No. 157 fair value hierarchy consists of three levels: Level 1 fair values are valuations based

on quoted market prices in active markets for identical assets or liabilities that the entity has the ability to

access; Level 2 fair values are those valuations based on quoted prices for similar assets or liabilities, quoted

prices in markets that are not active, or other inputs that are observable or can be corroborated by observable

data for substantially the full term of the assets or liabilities; and Level 3 fair values are valuations based on

inputs that are supported by little or no market activity and that are significant to the fair value of the assets or

liabilities.

SFAS No. 159 permits entities to choose to measure many financial instruments and certain other items at

fair value and establishes presentation and disclosure requirements designed to facilitate comparisons between

entities that choose different measurement attributes for similar assets and liabilities. The Company did not

elect the fair value option for any assets or liabilities in 2008. The adoption of SFAS No. 157 and

SFAS No. 159 did not have an impact on the Company’s consolidated balance sheet or statement of

operations. SFAS No. 157 is not required to be adopted for certain non-financial assets and liabilities until the

first day of fiscal 2009. The Company’s assets for which SFAS No. 157 was not adopted include the

Company’s goodwill and property rights, including the property rights recorded in connection with the

Company’s acquisition of Cranium, Inc. and TRIVIAL PURSUIT (see note 4).

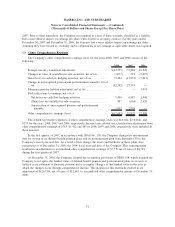

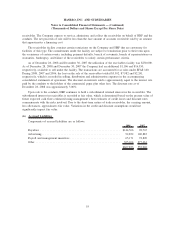

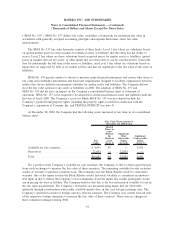

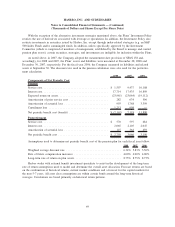

At December 28, 2008, the Company had the following assets measured at fair value in its consolidated

balance sheet:

Fair

Value

Quoted

Prices in

Active

Markets

for

Identical

Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Fair Value Measurements at

December 28, 2008 Using

Available-for-sale securities .................. $ 4,634 43 — 4,591

Derivatives .............................. 72,053 — 72,053 —

Total ................................... $76,687 43 72,053 4,591

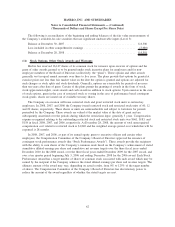

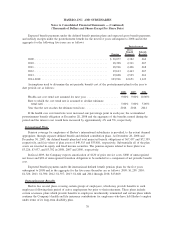

For a portion of the Company’s available-for-sale securities, the Company is able to obtain quoted prices

from stock exchanges to measure the fair value of these securities. The remaining available-for-sale securities

consist of warrants to purchase common stock. The Company uses the Black-Scholes model to value these

warrants. One of the inputs used in the Black-Scholes model, historical volatility, is considered an unobserv-

able input in that it reflects the Company’s own assumptions about the inputs that market participants would

use in pricing the asset or liability. The Company believes that this is the best information available for use in

the fair value measurement. The Company’s derivatives are measured using inputs that are observable

indirectly through corroboration with readily available market data, in this case foreign exchange rates. The

Company’s derivatives consist of foreign currency forward contracts. The Company uses current forward rates

of the respective foreign currencies to measure the fair value of these contracts. There were no changes in

these valuation techniques during 2008.

61

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)