Hasbro 2008 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2008 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

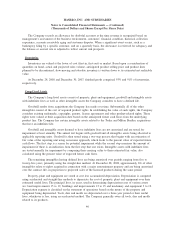

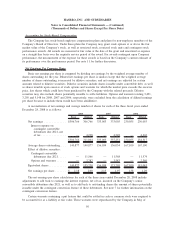

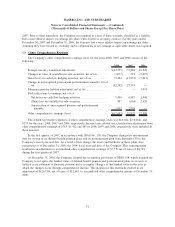

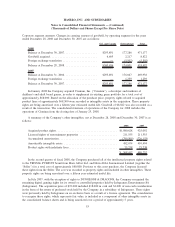

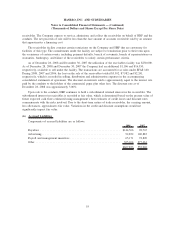

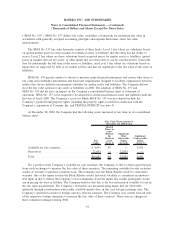

Corporate segment amounts. Changes in carrying amount of goodwill, by operating segment for the years

ended December 28, 2008 and December 30, 2007 are as follows:

U.S. and Canada International Total

2008

Balance at December 30, 2007 ..................... $293,891 177,286 471,177

Goodwill acquired .............................. 6,605 2,217 8,822

Foreign exchange translation ...................... — (5,502) (5,502)

Balance at December 28, 2008 ..................... $300,496 174,001 474,497

2007

Balance at December 31, 2006 ..................... $293,891 176,047 469,938

Foreign exchange translation ...................... — 1,239 1,239

Balance at December 30, 2007 ..................... $293,891 177,286 471,177

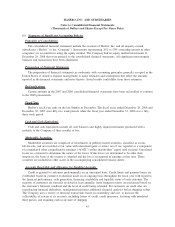

In January 2008 the Company acquired Cranium, Inc. (“Cranium”), a developer and marketer of

children’s and adult board games, in order to supplement its existing game portfolio for a total cost of

approximately $68,000. Based on the allocation of the purchase price, property rights related to acquired

product lines of approximately $68,500 were recorded as intangible assets in the acquisition. These property

rights are being amortized over a fifteen year estimated useful life. Goodwill of $8,822 was also recorded as a

result of the transaction. The consolidated statement of operations of the Company for 2008 includes the

operations of Cranium from the closing date of January 25, 2008.

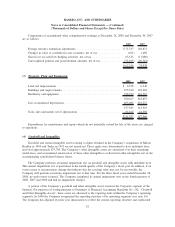

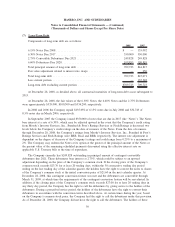

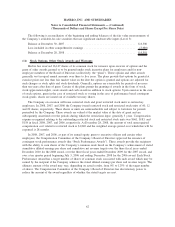

A summary of the Company’s other intangibles, net at December 28, 2008 and December 30, 2007 is as

follows:

2008 2007

Acquired product rights ....................................... $1,080,628 925,092

Licensed rights of entertainment properties ........................ 211,555 211,555

Accumulated amortization ..................................... (799,509) (726,153)

Amortizable intangible assets .................................. 492,674 410,494

Product rights with indefinite lives............................... 75,738 75,738

$ 568,412 486,232

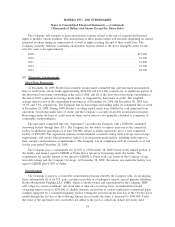

In the second quarter of fiscal 2008, the Company purchased all of the intellectual property rights related

to the TRIVIAL PURSUIT brand from Horn Abbot Ltd. and Horn Abbot International Limited (together the

“Seller”) for a total cost of approximately $80,800. Previous to this asset purchase, the Company licensed

these rights from the Seller. The cost was recorded as property rights and included in other intangibles. These

property rights are being amortized over a fifteen year estimated useful life.

In July 2007, with the exception of rights to DUNGEONS & DRAGONS, the Company reacquired the

remaining digital gaming rights for its owned or controlled properties held by Infogrames Entertainment SA

(Infogrames). The acquisition price of $19,000 included $18,000 in cash and $1,000 of non-cash consideration

in the form of the return of preferred stock held by the Company in a subsidiary of Infogrames. These rights

were previously held by Infogrames on an exclusive basis as a result of a license agreement. The consideration

to reacquire these rights, which represents fair value, is included as a component of other intangible assets in

the consolidated balance sheets and is being amortized over a period of approximately 5 years.

53

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)