Hasbro 2008 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2008 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company also seeks to drive product-related revenues by increasing the visibility of its core brands

through entertainment. As an example of this, in July of 2007, the TRANSFORMERS motion picture was

released and the Company developed and marketed products based on the motion picture. As a result of

pairing this core brand with this type of entertainment, both the movie and the product line benefited. The

Company expects to continue this strategy and anticipates the theatrical releases of both TRANSFORMERS:

REVENGE OF THE FALLEN and G.I. JOE: RISE OF COBRA motion pictures during 2009. In addition, the

Company has entered into a six-year strategic relationship with Universal Pictures to produce at least four

motion pictures based on certain of Hasbro’s core brands. The first movie is expected to be released in 2010

or 2011, followed by anticipated releases of at least one movie per year thereafter.

While the Company believes it has achieved a more sustainable revenue base by developing and

maintaining its core brands and avoiding reliance on licensed entertainment properties, it continues to

opportunistically enter into or leverage existing strategic licenses which complement its brands and key

strengths. In 2008 and 2007, the Company had significant sales of products related to the Company’s license

with Marvel Characters B.V. (“Marvel”), primarily due to the theatrical releases of IRON MAN in May 2008,

THE INCREDIBLE HULK in June 2008 and SPIDERMAN-3 in May 2007. In addition, the Company had

significant sales in 2008 of products related to the movie release of STAR WARS: CLONE WARS in August

2008 as well as sales from the movie release of INDIANA JONES AND THE KINGDOM OF THE

CRYSTAL SKULL in May 2008. During 2009 the Company expects to continue to have a high level of

revenues from entertainment-based licensed properties based on the expected major motion picture release of

X-MEN ORIGINS: WOLVERINE as well as products related to television programming based on SPIDER-

MAN and STAR WARS.

While gross profits of theatrical entertainment-based products are generally higher than many of the

Company’s other products, sales from these products including our owned or controlled brands based on a

movie release also incur royalty expense. Such royalties reduce the impact of these higher gross margins. In

certain instances, such as with Lucasfilm’s STAR WARS, the Company may also incur amortization expense

on property right-based assets acquired from the licensor of such properties, further impacting profits earned

on these products.

The Company’s long-term strategy also focuses on extending its brands further into the digital world. As

part of this strategy, the Company entered into a multi-year strategic agreement with Electronic Arts Inc.

(“EA”). The agreement gives EA the exclusive worldwide rights, subject to existing limitations on the

Company’s rights and certain other exclusions, to create digital games for all platforms, such as mobile

phones, gaming consoles and personal computers, based on a broad spectrum of the Company’s intellectual

properties, including MONOPOLY, SCRABBLE, YAHTZEE, NERF, TONKA, G.I. JOE and LITTLEST PET

SHOP. The first major game releases under this agreement were released in 2008, with a full line expected in

2009.

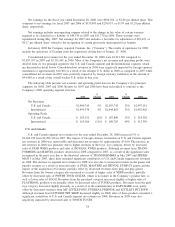

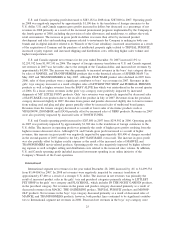

While the Company remains committed to investing in the growth of its business, it also continues to be

focused on reducing fixed costs through efficiencies and on profit improvement. Over the last 6 years the

Company has improved its full year operating margin from 7.8% in 2002 to 12.3% in 2008. The Company

reviews it operations on an ongoing basis and seeks to reduce its cost structure and promote efficiency. The

Company is also investing to grow its business in emerging markets. In 2008, the Company expanded its

operations in China, Brazil, Russia, Korea and the Czech Republic. In addition, the Company is seeking to

grow its business in entertainment, digital gaming, and will continue to evaluate strategic alliances and

acquisitions which may complement its current product offerings or allow it entry into an area which is

adjacent to and complementary to the toy and game business. For example, in January of 2008, the Company

acquired Cranium, Inc., a developer and marketer of CRANIUM branded games and related products. In the

second quarter of 2008, the Company acquired the rights to TRIVIAL PURSUIT, a brand which the Company

had previously licensed on a long-term basis. Ownership of the rights will allow the Company to further

leverage the brand in different media.

In recent years, the Company has been seeking to return excess cash to its shareholders through share

repurchases and dividends. As part of this initiative, over the last four years, the Company’s Board of Directors

22