Hasbro 2008 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2008 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

plan assets are valued on the basis of their fair market value on the measurement date. These changes in the

fair market value of plan assets impact the amount of future pension expense due to amortization of the

unrecognized actuarial losses.

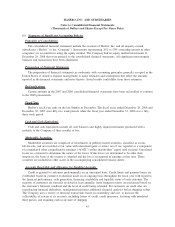

Stock-Based Compensation

The Company has a stock-based compensation plan for employees and non-employee members of the

Company’s Board of Directors. Under this plan, the Company may grant stock options at or above the fair

market value of the Company’s stock, as well as restricted stock, restricted stock units and contingent stock

performance awards. The Company measures all stock-based compensation awards using a fair value method

and records such expense in its consolidated financial statements. Total stock-based compensation expense

recognized for the years ended December 28, 2008, December 30, 2007 and December 31, 2006 was $35,221,

$29,402 and $22,832, respectively. As of December 28, 2008, total unrecognized stock-based compensation

cost was approximately $33,700.

The Company uses the Black-Scholes option pricing model to value stock options that are granted under

these plans. The Black-Scholes method includes four significant assumptions: (1) expected term of the options,

(2) risk-free interest rate, (3) expected dividend yield, and (4) expected stock price volatility. For the

Company’s 2008, 2007 and 2006 stock option grants, the weighted average expected term was approximately

5 years. This amount is based on a review of employees’ exercise history relating to stock options as well as

the contractual term of the option. The weighted average risk-free interest rates used for 2008, 2007 and 2006

stock option grants were 2.71%, 4.79% and 4.98%, respectively. This estimate was based on the interest rate

available on U.S. treasury securities with durations that approximate the expected term of the option. The

weighted average expected dividend yields used for the 2008, 2007 and 2006 stock option grants were 2.95%,

1.97% and 2.55%, respectively, which is based on the Company’s current annual dividend amount divided by

the stock price on the date of the grant. The weighted average expected stock price volatilities used were 22%

for 2008 and 2007 stock option grants and 24% for 2006 stock option grants. These amounts were derived

using a combination of current and historical implied price volatility. Implied price volatility reflects the

volatility implied in publicly traded options on the Company’s common stock, which the Company believes

represents the expected future volatility of the Company’s stock price. The Company believes that since this is

a market-based estimate, it provides a better estimate of expected future volatility as compared to based only

on historical volatility.

In 2008, 2007 and 2006, as part of its employee stock-based compensation plan, the Company issued

contingent stock performance awards, which provide the recipients with the ability to earn shares of the

Company’s common stock based on the Company’s achievement of stated cumulative diluted earnings per

share and cumulative net revenue targets over the three fiscal years ended December 2010 for the 2008 award,

over the three fiscal years ended December 2009 for the 2007 award, and over a ten quarter period beginning

July 3, 2006 and ending December 2008 for the 2006 award. Each award has a target number of shares of

common stock associated with such award which may be earned by the recipient if the Company achieves the

stated diluted earnings per share and net revenue targets. These awards are valued based on the fair market

value of the Company’s common stock on the date of the grant and expensed over the performance period.

The measurement of the expense related to this award is based on the Company’s current estimate of revenues

and diluted earnings per share over the performance period. Changes in these estimates may impact the

expense recognized related to these awards.

Income Taxes

The Company’s annual income tax rate is based on its income, statutory tax rates, changes in prior tax

positions, and tax planning opportunities available in the various jurisdictions in which it operates. Significant

judgment and estimates are required to determine the Company’s annual tax rate and in evaluating its tax

positions. Despite the Company’s belief that its tax return positions are fully supportable, these positions are

subject to challenge and estimated liabilities are established in the event that these positions are challenged

and the Company is not successful in defending these challenges. These estimated liabilities are adjusted, as

well as the related interest, in light of changing facts and circumstances, such as the progress of a tax audit.

35