DHL 1997 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 1997 DHL annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

At 26.6 percent, our equity ratio remained virtually unchanged from the

previous year’s level.

We slashed the amounts owed to banks by a substantial 34.4 percent to

DM 506 million during 1997. We were also able to reduce debt owed to

Deutsche Telekom AG listed under other liabilities by DM 392 million to

DM 1,038 million. This item involves the allocation of debt of the former

Deutsche Bundespost per Postreform II.

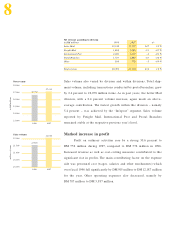

Large capital expenditures accelerate structural change

We also continued our planned multi-year investment program

during fiscal 1997. Additions to property, plant and equipment amount-

ing to DM 1,929 million (1996: DM 1,879 million) were financed entirely

from internally generated cash flow.

As in 1996, investment activity continued to focus on establishing new

production facilities for the Letter Mail business. The number of state-of-

the-art letter processing centers grew from 20 to 58 in 1997. This project

envisages a total of 83 centers and will be completed ahead of schedule

in late 1998.

As part of our efforts to increase the international orientation of our

corporation, we have successfully concluded several acquisitions during

the financial year.

Deutsche Post Express und Transport GmbH (Bonn) has acquired a

24.8 percent stake in trans-o-flex Schnell-Lieferdienst AG (Weinheim)

through a holding company. Along with our participation in the pan-

European Eurodis Network, the trans-o-flex acquisition, with its sub-

sidiaries in six countries, helps form a top-quality network that will

ensure better service for Deutsche Post customers, particularly in the

European region.

12

Capital expenditures property, plant and

equipment

1996 1997

1,879

1,929

2,000

2.250

1,750

1,500

1,250

1,000

in DM millions