DHL 1997 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 1997 DHL annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Net cash used for investing activities fell by DM 181 million to DM 311

million during 1997. This was mainly due to an above-average increase

in proceeds from the sale of fixed assets totaling DM 1,715 million for the

year, DM 213 million more than in fiscal 1996. Capital expenditures

could, in turn, be completely funded by net cash provided by operating

activities. The decrease by DM 753 million to DM 1,093 million in net

cash provided by operating activities during fiscal 1997 was primarily

due to an increase in receivables from the Deutsche Post Pensions-

Service e.V., which the Federal Government must settle.

The DM 657 million in net cash used for financing activities pertains

mainly to the repayment of debts.

Due to the favorable cash inflow we were able to further strengthen our

financial position as planned. Cash and cash equivalents increased by

DM 125 million to DM 2,107 million. Our net funding position has con-

tinually improved since January 1,1995, when Postreform II (second reform

of German posts and telecommunications) went into effect.

This solid financial strength will enable us to finance further corporate

growth using primarily our own resources.

10

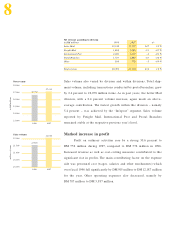

Statement of cash flow s (selected items)

in DM millions 1996 1997 +/–

Cash flow according to DVFA/SG formula 1,921 2,244 323

Net cash provided by operating activities 1,846 1,093 –753

Net cash used for investing activities –493 –311 181

Net cash used for financing activities –1,318 –657 661

Cash and cash equivalents 1,982 2,107 125

Net cash flow according to DVFA/ SG formula

1996 1997

1,921

2,244

2,500

2,000

1,500

1,000

500

in DM millions