DHL 1997 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 1997 DHL annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strengthened capital structure

Deutsche Post’s balance sheet total rose by 10.2 percent to

DM 21,346 million in 1997. A major reason for this increase was the

DM 2,410 million accrual of indirect pension obligations vis-à-vis our

employees.

The increase in shareholders’ equity with corresponding increase in as-

sets raised the balance sheet total. In connection with the signing of our

cooperation agreement with Postbank, Deutsche Post’s annual share-

holders’ meeting voted on July 10, 1997, to increase share capital by

DM 140 million. The Federal Government subscribed the new shares,

paying for the investment by assuming the obligation to transfer 2.8

million Deutsche Postbank AG shares with a nominal value of DM 50 per

share to Deutsche Post AG on January 1, 1999. The number of shares

constitutes a 17.5 percent stake in Postbank. The difference between the

amount of increase in share capital and the valuation of the shares

the Government is to transfer to Deutsche Post was allocated to capital

reserves.

11

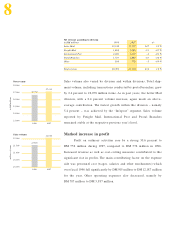

Selected balance sheet items

in DM millions 1996 1997 +/–

Balance sheet total 19,370 21,346 10.2 1,976

Shareholders’ equity 5,195 5,687 9.5 492

of which subscribed capital 2,000 2,140 7.0 140

Accruals 8,864 10,836 22.2 1,972

of which for pensions and similar obligations 1,072 3,434 220.3 2,362

Payables 5,311 4,823 –9.2 –488

of which to banks 772 506 –34.4 –266

of which to Telekom AG 1,430 1,038 –27.5 –392

Equity ratio 26.8 % 26.6 %