Chevron 2010 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2010 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48 Chevron Corporation 2010 Supplement to the Annual Report

Downstream Refining and Marketing

Refining and Marketing

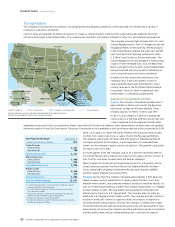

The company’s refining and marketing activities are coordinated by two geographic organizations, Americas Products and International

Products, focused on optimizing the fuels value chain from crude to customer. Each organization’s activities include securing raw materi-

als, manufacturing and blending products at its refineries, and selling finished products through its marketing and commercial networks.

Americas Products

The organization serves commercial and industrial, wholesale, aviation, and retail customers in Canada, Latin America and the United

States through the world-class Chevron and Texaco brands.

Serving the Crude-to-Customer Value Chain

The Americas Products portfolio includes six wholly owned refineries in North America with a crude capacity of approximately 1 million

barrels per day. Many of these refineries have hydroprocessing units capable of converting lower-quality crude oil into a variety of

mid-distillate products.

Through a network of more than 80 fuel terminals, the company serves customers at approximately 9,800 Chevron- and Texaco-branded

retail outlets in Canada, Latin America and the United States. During 2010, the organization sold a daily average of approximately 1.6 million

barrels of gasoline and other refined products. Chevron continues to leverage its proprietary Techron technology in these markets in order

to maintain a leading position in branded fuels. Additionally, Chevron is a major supplier of commercial aviation fuel in the United States.

Selectively Improving Refining Flexibility and Yield

In 2010, the company continued work on projects to improve refinery flexibility and the capability to

process lower-cost feedstocks. In late 2010, construction began on a new processing unit designed to

further improve the El Segundo, California, refinery’s reliability, high-value product yield and flexibility

to process a range of crude slates. Project completion is scheduled for 2012.

Additionally, in fourth quarter 2010, the company commissioned a continuous catalytic reformer at the

Pascagoula, Mississippi, refinery, which will improve equipment reliability and utilization and allow the

refinery to optimize production of high-value products. Also in Pascagoula, engineering and procure-

ment activities continued on a lubricant base-oil facility. For additional details about this project, refer

to the Lubricants section on page 50.

Aligning the Marketing Portfolio

Through market exits and divestitures, the company continues to align its marketing portfolio to

source a greater percentage of its refined product sales directly from Chevron’s refineries. During

2010, the company discontinued sales of Chevron- and Texaco-branded motor fuels in the District of

Columbia, Delaware, Indiana, Kentucky, North Carolina, New Jersey, Maryland, Ohio, Pennsylvania,

South Carolina, Virginia, West Virginia and parts of Tennessee, where the company previously sold

to retail customers through approximately 1,100 stations and to commercial and industrial customers

through supply arrangements. Sales in these markets represented approximately 8 percent of the

company’s total U.S. retail fuel sales volumes in 2009.

Also in 2010 and early 2011, the company completed eight of its 13 planned U.S. terminal divestitures to

strengthen the cost-competitiveness of its terminal network while maintaining the necessary scale to

meet the needs of its customers. In 2011, the company expects to complete the sale of additional U.S.

terminals as part of the previously announced plan to divest 13 facilities. Additionally, the company

intends to grow sales of motor gasoline and diesel fuel under the premium Chevron and Texaco brands

in select markets primarily in the western, southeastern and Gulf Coast regions of the United States,

where the company enjoys leading market positions.

The company also signed an agreement in late 2010 for the sale of its fuels-marketing and aviation businesses in Antigua, Barbados,

Belize, Costa Rica, Dominica, French Guiana, Grenada, Guadeloupe, Guyana, Martinique, Nicaragua, St. Kitts, St. Lucia, St. Vincent, and

Trinidad and Tobago and expects to complete all transactions by third quarter 2011, following the receipt of local regulatory and govern-

ment approvals.

0

5

10

15

20

25

30

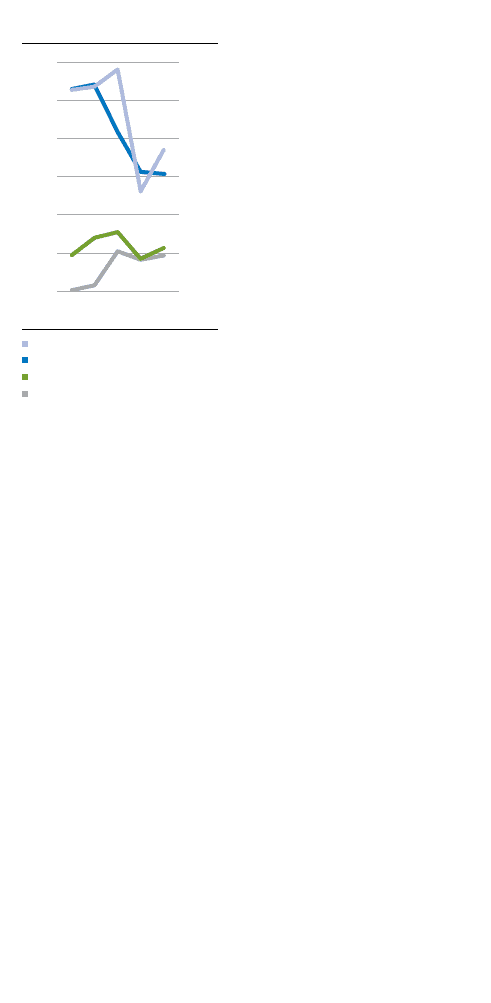

U.S. West Coast (Blended 5–3–1–1)*

U.S. Gulf Coast (Maya 5–3–1–1)*

Singapore (Dubai 3–1–1–1)*

Northwest Europe (Brent 3–1–1–1)*

Industry Refining Margins

Dollars per barrel

*Numbers: A–B–C–D

A = Crude oil

B = Motor gasoline

C = Diesel fuel — U.S.

C = Gas oil — Non–U.S.

D = Jet fuel — U.S.

D = Fuel oil — Non–U.S.

0706 08 09 10