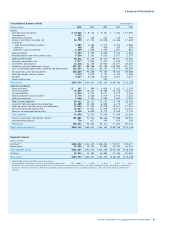

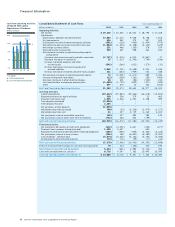

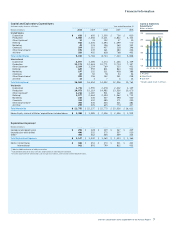

Chevron 2010 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2010 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

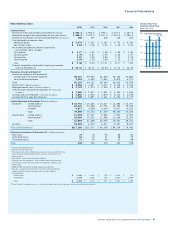

Financial Information

8 Chevron Corporation 2010 Supplement to the Annual Report

0.0

25.0

50.0

75.0

125.0

100.0

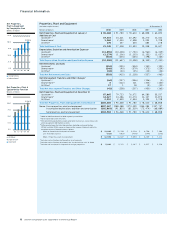

Net Properties,

Plant & Equipment

by Geographic Area

Billions of dollars

0706 08 09 10

$104.5

United States

International

Net Properties, Plant &

Equipment by Function

Billions of dollars

All Other

Downstream

Upstream

0.0

25.0

50.0

75.0

125.0

100.0

0706 08 09 10

$104.5

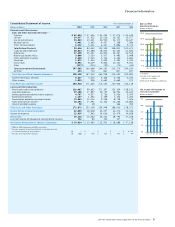

Properties, Plant and Equipment

(Includes capital leases) At December 31

Millions of dollars 2010 2009 2008 2007 2006

Net Properties, Plant and Equipment at January 1 $ 96,468 $ 91,780 $ 78,610 $ 68,858 $ 63,690

Additions at Cost

Upstream1,2 19,315 14,321 20,392 16,270 11,041

Downstream1 1,560 2,330 2,598 2,093 1,708

All Other3 270 357 603 685 278

Total Additions at Cost 21,145 17,008 23,593 19,048 13,027

Depreciation, Depletion and Amortization Expense4

Upstream1 (11,055 ) (10,238 ) (7,750 ) (6,960 ) (6,029 )

Downstream1 (1,179 ) (1,106 ) (1,103 ) (1,151 ) (1,037 )

All Other3 (316 ) (303 ) (245 ) (198 ) (165 )

Total Depreciation, Depletion and Amortization Expense (12,550 ) (11,647 ) (9,098 ) (8,309 ) (7,231 )

Net Retirements and Sales

Upstream1 (254 ) (295 ) (504 ) (151 ) (192 )

Downstream1 (246 ) (90 ) (579 ) (373 ) (239 )

All Other3 (18 ) (30 ) (35 ) (13 ) (34 )

Total Net Retirements and Sales (518 ) (415 ) (1,118 ) (537 ) (465 )

Net Intersegment Transfers and Other Changes5

Upstream1,6 (64 ) (137 ) (346 ) (136 ) (2 )

Downstream1,6 6 (122 ) 121 (305 ) (140 )

All Other3 17 1 18 (9 ) (21 )

Total Net Intersegment Transfers and Other Changes (41 ) (258 ) (207 ) (450 ) (163 )

Net Properties, Plant and Equipment at December 31

Upstream1,7 87,665 79,723 76,072 64,280 55,257

Downstream1 14,327 14,186 13,174 12,137 11,873

All Other3 2,512 2,559 2,534 2,193 1,728

Total Net Properties, Plant and Equipment at December 31 $ 104,504 $ 96,468 $ 91,780 $ 78,610 $ 68,858

Memo: Gross properties, plant and equipment $ 207,367 $ 188,288 $ 173,299 $ 154,084 $ 137,747

Accumulated depreciation, depletion and amortization (102,863 ) (91,820 ) (81,519 ) (75,474 ) (68,889 )

Net properties, plant and equipment $ 104,504 $ 96,468 $ 91,780 $ 78,610 $ 68,858

1 2006 to 2009 conformed to 2010 segment presentation.

2 Net of exploratory well write-offs.

3 Primarily mining operations, power generation businesses, real estate assets

and management information systems.

4 Difference between the total depreciation, depletion and amortization

(DD&A) and total DD&A expense shown on the income statement relates to

accretion expense. Reconciliation as follows:

DD&A on consolidated statement of income $ 13,063 $ 12,110 $ 9,528 $ 8,708 $ 7,506

Less: Accretion expense (513 ) (463 ) (430 ) (399 ) (275 )

DD&A – Properties, plant and equipment $ 12,550 $ 11,647 $ 9,098 $ 8,309 $ 7,231

5 Includes reclassifications to/from other asset accounts.

6 Includes reclassification adjustments for “Assets held for sale” in 2008.

7 Includes net investment in unproved oil and gas properties: $ 5,081 $ 5,321 $ 5,367 $ 4,927 $ 5,218