Chevron 2010 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2010 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chevron Corporation 2010 Supplement to the Annual Report 1

2010 at a Glance

Corporate Strategies

Financial-return objective – Create shareholder value and achieve sustained financial returns from

operations that will enable Chevron to outperform its competitors.

Enterprise strategies – Invest in people to strengthen organizational capability and develop a talented

global workforce that gets results the right way. Execute with excellence through rigorous application of

the company’s operational excellence and capital stewardship systems and disciplined cost management.

Grow profitably by using competitive advantages to maximize value from existing assets and capture

new opportunities.

Major business strategies – Upstream – grow profitably in core areas, build new legacy positions and

commercialize the company’s equity natural gas resource base while growing a high-impact global gas

business. Downstream – improve returns and grow earnings across the value chain. The company also

continues to utilize technology across all its businesses to differentiate performance and to invest in

profitable renewable energy and energy efficiency solutions.

Accomplishments

Corporate

Safety – Achieved the company’s safest year ever, setting new world-class safety records in the days-

away-from-work performance metric in both Upstream and Downstream operations.

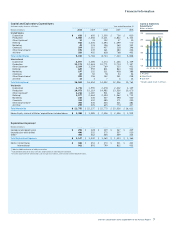

Financial – Achieved the highest operating cash flows in the company’s history, at approximately $31 billion,

and a total stockholder return that led the peer group for the previous five-year period.

Dividends – Paid $5.7 billion in dividends with 2010 marking the 23rd consecutive year of higher annual

dividend payouts. Annual average dividend growth over the period was 7 percent.

Capital and exploratory expenditures – Invested $21.8 billion in the company’s businesses, including

$1.4 billion (Chevron share) of spending by affiliates. Announced 2011 projected outlays of $26.0 billion,

including $2.0 billion of affiliate expenditures. Focus continues on exploration and production activities.

Stock repurchase program – Resumed the company’s common stock repurchases in the fourth quarter,

acquiring $750 million of the company’s shares.

Upstream

Exploration – Achieved an exploration drilling success rate of 57 percent. Results included several natural

gas discoveries offshore western Australia. Additionally, acquired offshore exploration leases in China, Liberia,

Turkey and the United States and captured of shale gas acreage in Canada, Poland and Romania.

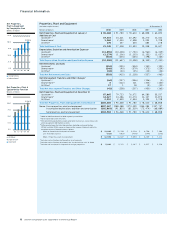

Production – Produced 2.763 million net oil-equivalent barrels per day, approximately a 2 percent increase

over 2009, with about 75 percent of the volume outside the United States in more than 20 different countries.

Acquisition – Announced plans to acquire Atlas Energy, Inc., providing a shale gas acreage position in the

Marcellus Shale, primarily located in southwestern Pennsylvania. (Acquisition completed in February 2011.)

Major projects – Continued progress on the company’s development projects to deliver future production

growth. Achieved first production at the deepwater Perdido Regional Development Project and the Athabasca

Oil Sands Project Expansion and continued to increase production at the Tengizchevroil Sour Gas Injection/

Second Generation Plant Project in Kazakhstan. The company also reached final investment decision on a

number of major capital projects, including Jack/St. Malo, Big Foot and Tahiti 2 in the Gulf of Mexico; Papa-

Terra in Brazil; and expansion of the Caspian pipeline in Kazakhstan and Russia.

Natural gas projects – Delivered first gas from the Escravos Gas Project Phase 3A in Nigeria. In Australia,

continued construction on Barrow Island and awarded approximately $25 billion of contracts for materials and

services for the Gorgon Project. The company also executed additional binding and nonbinding agreements

with Asian customers for the delivery of liquefied natural gas from the Gorgon and Wheatstone projects.

Downstream

Refinery upgrades – Completed project start-ups, including the Pascagoula, Mississippi, refinery continuous

catalytic reformer and the Yeosu, South Korea, gas-oil hydrocracker. Construction also began on a processing

unit designed to further improve the El Segundo, California, refinery’s reliability, high-value product yield and

flexibility to process a range of crude slates.

Chemical – Commenced operations on the ethylene cracker and polyethylene/normal alpha olefins plants in

Qatar. Continued construction on a petrochemical project in Saudi Arabia with start-up expected in late 2011.

Sale of nonstrategic assets – Sold a 23.4 percent ownership interest in Colonial Pipeline in the United States.

Additionally, concluded the sales of businesses in Malawi, Réunion and Zambia and 21 product terminals.

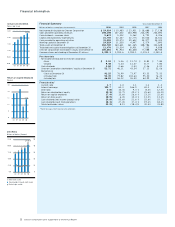

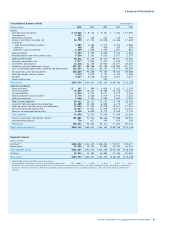

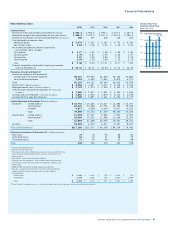

Financial Highlights:

• Sales and other

operating revenues

$198 billion

• Net income attributable

to Chevron Corporation

$19.0 billion

$9.48 per share – diluted

• Return on capital employed

17.4%

• Return on stockholders’

equity

19.3%

• Cash dividends

$2.84 per share