Chevron 2010 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2010 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chevron Corporation 2010 Supplement to the Annual Report 47

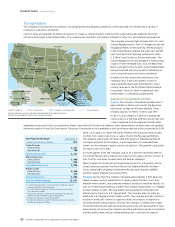

Highlights Downstream

Fuel Refinery Major Chemical Manufacturing Facility

Downstream Overview

Highlights

The company enjoys a strong presence in all aspects of the down-

stream industry — refining, marketing, chemicals and transportation.

Industry Conditions

Earnings in refining and marketing in 2010 improved from historic

lows in 2009 due to recovering global demand, but remained

relatively weak with continued economic softness, excess refined

product supplies and surplus refining capacity. Worldwide demand

for motor gasoline, jet fuel, naphtha and distillates grew by approx-

imately 3.2 percent in 2010 from depressed levels in the prior year.

Despite some capacity coming offline, global refining capacity

increased by 1 million barrels per day, according to the December

2010 Oil & Gas Journal survey. Overall, these factors contributed to

a modest recovery in refining margins during 2010 from very weak

levels in 2009. Worldwide marketing margins remained narrow in

2010, but were above 2009 levels.

Chemicals experienced improved business conditions driven by a rebound in product demand. Globally, demand recovered in electrical

and electronic applications, transportation, and consumer packaging, which bolstered sales and margins.

Business Strategies

Improve returns and grow earnings across the value chain by:

• Achieving world-class safety and reliability performance.

• Continuing to improve execution of the base business.

• Driving earnings across the crude-to-customer value chain.

• Adding value to upstream operations through integration, technology and organizational capability.

2010 Accomplishments

• Achieved the lowest-ever total number of recordable safety incidents.

• Reported net income of $2.5 billion, including strong financial performance in the lubricants and chemicals businesses.

• Commissioned a new 60,000-barrel-per-day heavy-oil hydrocracker at the Yeosu Refinery in South Korea and a continuous catalytic

reformer at the Pascagoula, Mississippi, refinery.

• Commenced operations on two projects in Qatar, including an ethylene cracker located in Ras Laffan and a polyethylene and normal

alpha olefins complex located in Mesaieed.

• Restructured the refining and marketing business to improve operating efficiency, reduce costs and achieve sustained improvement

in financial performance. Completed the sale of businesses in Mauritius, Réunion and Zambia and 21 product terminals.

2011 Outlook

Expecting ongoing challenging industry conditions, Downstream will continue to focus on lowering operating costs and sustaining

reduced capital spending in order to improve efficiency and financial returns. Key objectives include the following:

• Continue to improve safety and refinery reliability.

• Streamline the company’s refining and marketing asset portfolio.

• Advance projects that improve refinery feedstock flexibility, high-value product yield and energy efficiency.

• Advance projects in the chemicals and base-oil manufacturing businesses that add capacity to serve key markets.

• Complete cost-reduction programs as part of the restructuring that was announced in 2010.

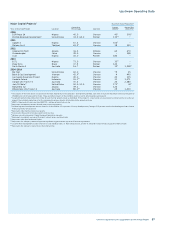

Downstream Financial and Operating Highlights

(Includes equity share in affiliates)

Dollars in millions 2010 2009

Segment earnings* $ 2,478 $ 473

Refinery crude oil inputs (Thousands of barrels per day) 1,894 1,878

Refinery capacity at year-end (Thousands of barrels per day) 2,160 2,158

U.S. gasoline and jet fuel yields (Percent of U.S. refinery production) 64% 65%

Refined product sales (Thousands of barrels per day) 3,113 3,254

Motor gasoline sales (Thousands of barrels per day) 1,221 1,275

Natural gas liquids (NGLs) sales (Thousands of barrels per day) 217 232

Number of marketing retail outlets at December 31 19,547 21,574

Refining capital expenditures* $ 1,577 $ 2,464

Marketing capital expenditures $ 246 $ 335

Chemicals and other downstream capital expenditures* $ 729 $ 737

Total downstream capital expenditures* $ 2,552 $ 3,536

* 2009 conformed to 2010 segment presentation.