Albertsons 2002 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2002 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

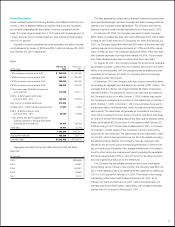

In July 2001, the Company amended its postretirement health care and

life insurance benefit plan, making changes to plan eligibility, benefit cover-

age, and premium subsidization. This amendment resulted in a decrease in

the plan’s benefit obligation of approximately $8.3 million in fiscal 2002.

For both the pension and the postretirement benefit calculations, the

weighted-average discount rate used was 7.25 percent and 7.75 percent

for fiscal 2002 and 2001, respectively, the expected return on plan assets

used was 10.0 percent for both fiscal 2002 and 2001, and the rate of

compensation increase was 3.5 percent and 4.0 percent for fiscal 2002

and 2001, respectively.

The assumed health care cost trend rate used in measuring the accu-

mulated postretirement benefit obligation was 10.0 percent in fiscal 2002

and 6.0 percent in fiscal 2001. The assumed health care cost trend rate

will decrease by one percent each year for the next five years until it

reaches the ultimate trend rate of 5.0 percent. The health care cost trend

rate assumption has a significant impact on the amounts reported. For

example, a one percent increase in the trend rate would increase the accu-

mulated postretirement benefit obligation by $7.7 and $10.1 million in fiscal

2002 and 2001, respectively, and the net periodic cost by $0.6 and $1.0

million in fiscal 2002 and 2001, respectively. In contrast, a one percent

decrease in the trend rate would decrease the accumulated postretirement

benefit obligation by $7.2 and $7.7 million in fiscal 2002 and 2001, respec-

tively, and the net periodic cost by $0.5 and $0.8 million in fiscal 2002 and

2001, respectively.

The Company also maintains non-contributory, unfunded pension plans

to provide certain employees with pension benefits in excess of limits

imposed by federal tax law. The projected benefit obligation of the

unfunded plans was $18.8 and $21.0 million at February 23, 2002 and

February 24, 2001, respectively. The accumulated benefit obligation of

these plans totaled $14.2 and $17.0 million at February 23, 2002 and

February 24, 2001, respectively. Net periodic pension cost was $2.8, $2.2

and $3.5 million for 2002, 2001, and 2000, respectively.

Segment Information

The Company’s business is classified by management into two reportable

segments: Retail Food and Food Distribution. Retail Food operations

include three retail formats: extreme value food stores, price superstores,

and supermarkets. The retail formats include results of food stores owned

and results of sales to extreme value food stores licensed by the Company.

Food Distribution operations represent the second reportable segment and

include results of sales to affiliated food stores, mass merchants, and other

logistics arrangements. Management utilizes more than one measurement

and multiple views of data to assess segment performance and to allocate

resources to the segments. However, the dominant measurements are

consistent with the consolidated financial statements and accordingly, are

reported on the same basis herein.

The financial information concerning the Company’s continuing opera-

tions by reportable segment for the years ended February 23, 2002,

February 24, 2001 and February 26, 2000 is contained on page 19.

Significant Customer

During fiscal 2002, no single customer accounted for ten percent or greater

of net sales or accounts receivable. During fiscal 2001, Kmart represented

10.5 percent of net sales. Receivables outstanding for Kmart at February 24,

2001 were $70.0 million or 11.4 percent. The supply contract with Kmart

terminated on June 30, 2001. During fiscal 2000, no single customer

accounted for ten percent or greater of net sales or accounts receivable.

Shareholder Rights Plan

On April 24, 2000, the Company announced that the Board of Directors

adopted a Shareholder Rights Plan under which one preferred stock pur-

chase right will be distributed for each outstanding share of common

stock. The rights, which expire on April 12, 2010, are exercisable only

under certain conditions, and may be redeemed by the Board of Directors

for $0.01 per right. The plan contains a three-year independent director

evaluation provision whereby a committee of the Company’s independent

directors will review the plan at least once every three years. The rights

become exercisable, with certain exceptions, after a person or group

acquires beneficial ownership of 15 percent or more of the outstanding

voting stock of the Company.

33