Albertsons 2002 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2002 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

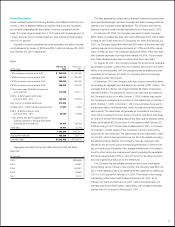

February 23, 2002 February 24, 2001 February 26, 2000

(In thousands) (52 weeks) (52 weeks) (52 weeks)

Cash flows from operating activities

Net earnings $ 205,535 $ 81,965 $ 242,941

Adjustments to reconcile net earnings to net cash provided by operating activities:

Depreciation and amortization 340,750 343,779 277,062

LIFO expense 143 4,991 8,253

Provision for losses on receivables 19,898 23,107 9,895

Gain on sale of Hazelwood Farms Bakeries ——(163,662)

Restructure and other charges 46,300 171,264 103,596

Deferred income taxes 76,360 (38,480) (21,041)

Other adjustments, net 1,382 829 2,032

Changes in assets and liabilities, excluding effect from acquisitions:

Receivables 103,389 (43,582) (58,887)

Inventories 304,779 135,402 (195,192)

Accounts payable (349,463) (66,824) 61,997

Other assets and liabilities 37,629 38,774 74,178

Net cash provided by operating activities 786,702 651,225 341,172

Cash flows from investing activities

Additions to long-term notes receivable (37,372) (69,875) (55,162)

Proceeds received on long-term notes receivable 47,794 69,439 52,101

Proceeds from sale of assets 89,504 48,179 374,714

Purchase of property, plant and equipment (292,927) (397,715) (407,947)

Business acquisitions, net of cash acquired ——(480,502)

Other investing activities (51,093) (30,389) (17,704)

Net cash used in investing activities (244,094) (380,361) (534,500)

Cash flows from financing activities

Net (decrease) increase in checks outstanding, net of deposits (77,764) (13,537) 23,529

Net (reduction) issuance of short-term notes payable (551,574) 2,526 472,670

Proceeds from issuance of long-term debt 218,014 60,000 594,485

Repayment of long-term debt (16,867) (171,692) (672,303)

Reduction of obligations under capital leases (25,988) (28,220) (28,376)

Net proceeds from the sale of common stock under option plans 19,453 457 2,381

Redemption of preferred stock ——(5,908)

Dividends paid (74,024) (72,244) (66,932)

Payment for purchase of treasury stock (32,083) (48,678) (122,906)

Net cash (used in) provided by financing activities (540,833) (271,388) 196,640

Net increase (decrease) in cash and cash equivalents 1,775 (524) 3,312

Cash and cash equivalents at beginning of year 10,396 10,920 7,608

Cash and cash equivalents at end of year $ 12,171 $ 10,396 $ 10,920

Supplemental Cash Flow Information

The Company’s non-cash investing and financing activities were as follows:

Leased asset additions and related obligations $ 95,730 $ 113,958 $ 131,316

Acquisitions:

Fair value of assets acquired $ —$ —$1,951,004

Cash paid ——481,861

Common stock issued ——457,502

Liabilities assumed ——1,011,641

Interest paid $ 184,719 $ 213,572 $ 138,415

Income taxes paid $ 102,123 $ 75,266 $ 245,177

See notes to consolidated financial statements.

Consolidated Statements of Cash Flows

23