Albertsons 2002 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2002 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

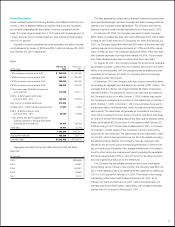

Direct financing leases: Under direct financing capital leases, the

Company leases buildings on behalf of independent retailers with terms

ranging from 5 to 20 years. Future minimum rentals to be received under

direct financing leases and related future minimum obligations under capi-

tal leases in effect at February 23, 2002 are as follows:

(In thousands) Direct Financing Capital Lease

Fiscal Year Lease Receivables Obligations

2003 $ 12,821 $ 12,714

2004 11,748 11,706

2005 10,794 10,771

2006 10,046 10,025

2007 9,407 9,511

Later 57,366 56,494

Total minimum lease payments 112,182 111,221

Less unearned income 36,670 —

Less interest —37,810

Present value of net minimum lease payments 75,512 73,411

Less current portion 6,960 7,080

Long-term portion $ 68,552 $ 66,331

Income Taxes

The provision for income taxes consists of the following:

(In thousands) 2002 2001 2000

Current

Federal $ 54,034 $96,022 $187,788

State 8,524 15,450 38,245

Tax credits (750) (600) (479)

Deferred

Restructure and other items 18,590 (63,452) (31,678)

Other 57,770 24,972 10,637

Total provision $138,168 $72,392 $204,513

The difference between the actual tax provision and the tax provision

computed by applying the statutory federal income tax rate to earnings

before taxes is attributable to the following:

(In thousands) 2002 2001 2000

Federal taxes based on

statutory rate $120,296 $54,025 $156,609

State income taxes, net of

federal benefit 11,961 5,267 19,196

Nondeductible goodwill 15,439 22,354 11,118

Asset sale basis difference ——24,238

Audit settlements (4,583) (6,539) —

Other (4,945) (2,715) (6,648)

Total provision $138,168 $72,392 $204,513

Temporary differences which give rise to significant portions of the net

deferred tax asset (liability) as of February 23, 2002 and February 24, 2001

are as follows:

(In thousands) 2002 2001

Deferred tax assets:

Restructure and other items $ 90,207 $ 108,797

Net operating loss from acquired subsidiaries 42,131 48,193

Provision for obligations to be settled in

future periods 133,013 133,647

Inventories 11,062 14,175

Other 25,127 31,022

Total deferred tax assets 301,540 335,834

Deferred tax liabilities:

Depreciation and amortization (76,381) (76,181)

Acquired assets adjustment to fair values (54,842) (48,439)

Tax deductions for benefits to be paid in

future periods (145,086) (114,574)

Other (71,994) (67,043)

Total deferred tax liabilities (348,303) (306,237)

Net deferred tax (liability) asset $ (46,763) $ 29,597

The Company currently has net operating loss (NOL) carryforwards

from acquired companies of $104.1 million for tax purposes, which expire

beginning in 2005 and continuing through 2018.

Temporary differences attributable to obligations to be settled in future

periods consist primarily of accrued post-retirement benefits and vacation

pay, and other expenses that are not deductible for income tax purposes

until paid.

Stock Option Plans

The Company’s 1997, 1993 and SUPERVALU/Richfood 1996 stock option

plans allow the granting of non-qualified stock options and incentive stock

options to key salaried executive employees at prices not less than 100

percent of fair market value, determined by averaging the open and close

price on the date of grant. The Company’s 1983 plan no longer allows

granting of stock options, but outstanding options remain to be exercised.

On August 31, 1999 the Company acquired Richfood, and in connection

therewith assumed all outstanding options and shares available for grant

related to existing Richfood stock option plans, based on the exchange

factor set forth in the merger agreement. In February 2000, the Board of

Directors reserved an additional 3.0 million shares for issuance under stock

option plans. The plans provide that the Board of Directors or the Executive

Personnel and Compensation Committee of the Board (the Committee)

may determine at the time of granting whether each option granted will be

a non-qualified or incentive stock option under the Internal Revenue Code.

29