Albertsons 2002 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2002 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

for twenty of the last thirty trading days of any fiscal quarter exceeds certain

levels, set initially at $33.20 per share for the quarter ended February 23,

2002, and rising to $113.29 per share at September 6, 2031. In the event

of conversion, 9.6434 shares of the Company’s common stock will be

issued per $1,000 debenture. The debentures have an initial yield to matu-

rity of 4.5%, which is being accreted over the life of the debentures using

the effective interest method.

SUPERVALU’s capital budget for fiscal 2003, which includes capitalized

leases, is projected at approximately $500 to $525 million, compared with

actual spending of $388.7 million in fiscal 2002. The capital budget for 2003

anticipates cash spending of $420 to $445 million, in addition to $80 million

budgeted for capital leases. Approximately $340 million of the fiscal 2003

budget has been identified for use in the Company’s retail food business.

The budget provides for approximately 10 to 15 new price superstores

and approximately 150 to 170 new extreme value stores including the

announced acquisition of 45 extreme value general merchandise stores.

The balance of the fiscal 2003 capital budget relates to distribution mainte-

nance capital and information technology related items. In addition, the

Company will continue to support store development and financing for the

Company’s independent retailers. Certain retailer financing activities do not

require new cash outlays because they are leases or guarantees. The capi-

tal budget does include amounts for projects which are subject to change

and for which firm commitments have not been made.

Cash dividends declared during fiscal 2002, 2001 and 2000 totaled

$0.5575 cents, $0.5475 cents, and $0.5375 cents per common share,

respectively. The Company’s dividend policy will continue to emphasize a

high level of earnings retention for growth.

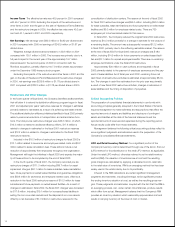

The following table represents the Company’s total commitments and total off-balance sheet arrangements at February 23, 2002.

Amount of Commitment Expiration Per Period

(In thousands) Total Amount Committed Fiscal 2003 Fiscal 2004-2005 Fiscal 2006-2007 Thereafter

Commitments:

Notes Payable $ 27,465 $ 27,465 $ — $ — $ —

Debt 1,668,694 326,266 472,154 135,938 734,336

Capital and Deferred Financing Leases 563,587 30,142 82,919 79,838 370,688

Total Commitments $2,259,746 $383,873 $555,073 $215,776 $1,105,024

Off-Balance Sheet Arrangements:

Retailer Loan and Lease Guarantees $ 215,200 $ 39,200 $ 54,500 $ 36,600 $ 84,900

Limited Recourse Liability on Notes Receivable 12,100 2,000 4,300 3,600 2,200

Purchase Options on Synthetic Leases 85,000 —85,000 ——

Operating Leases 996,728 136,826 228,364 173,869 457,669

Total Off-Balance Sheet Arrangements $1,309,028 $178,026 $372,164 $214,069 $ 544,769

Commitments, Contingencies and Off-Balance Sheet

Arrangements

The Company has guaranteed mortgage loan and other debt obligations

of $6.7 million. The Company has also guaranteed the leases and fixture

financing loans of various retailers with a present value of $174.8 million

and $33.7 million, respectively.

On December 4, 1998, the Company entered into an agreement to

sell notes receivable to a special purpose entity, which qualifies to be

accounted for as an unconsolidated subsidiary. The entity is designed to

acquire qualifying notes receivable from the Company and sell them to a

third party. No notes have been sold since February 29, 2000. Assets and

related debt off-balance sheet were $27.0 million at February 23, 2002 and

$46.4 million at February 24, 2001. At February 23, 2002, the Company’s

limited recourse with respect to notes sold was $12.1 million.

The Company is party to synthetic leasing programs for two of its major

warehouses. The leases expire in fiscal 2004 and fiscal 2005 and may be

renewed with the lessor’s consent through fiscal 2009 and fiscal 2007, and

have purchase options of $60 million and $25 million, respectively. At

February 23, 2003, the estimated market value of the properties underlying

these leases equaled or exceeded the purchase options. See further dis-

closure in the Company’s footnote on Commitments, Contingencies and

Off-Balance Sheet Arrangements.

The Company is a party to various legal proceedings arising from

the normal course of business activities, none of which, in management’s

opinion, is expected to have a material adverse impact on the Company’s

consolidated statement of earnings or consolidated financial position.

16