Albertsons 2002 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2002 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Company is authorized to purchase up to 5.0 million shares for reissuance

upon the exercise of employee stock options and for other compensation

programs utilizing the Company’s stock. In fiscal 2002, the Company

repurchased 1.3 million shares at an average cost of $22.16 per share

under the 2002 program.

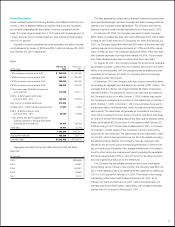

Earnings Per Share

The following table reflects the calculation of basic and diluted earnings

per share:

(In thousands, except per share amounts) 2002 2001 2000

Earnings per share – basic

Earnings available to common

shareholders $205,535 $ 81,965 $242,941

Weighted average shares

outstanding 132,940 132,251 129,162

Earnings per share – basic $ 1.55 $ 0.62 $ 1.88

Earnings per share – diluted

Earnings available to common

shareholders $205,535 $ 81,965 $242,941

Weighted average shares

outstanding 132,940 132,251 129,162

Dilutive impact of options

outstanding 1,038 578 928

Weighted average shares and

potential dilutive shares

outstanding 133,978 132,829 130,090

Earnings per share – diluted $ 1.53 $ 0.62 $ 1.87

Commitments, Contingencies and Off-Balance

Sheet Arrangements

The Company has guaranteed mortgage loan and other debt obligations

of $6.7 million. The Company has also guaranteed the leases and fixture

financing loans of various affiliated retailers with a present value of

$174.8 million and $33.7 million, respectively.

On December 4, 1998, the Company entered into an agreement to

sell notes receivable to a special purpose entity, which qualifies to be

accounted for as an unconsolidated subsidiary. The entity is designed to

acquire qualifying notes receivable from the Company and sell them to a

third party. No notes have been sold since February 29, 2000. Assets and

related debt off-balance sheet were $27.0 million at February 23, 2002 and

$46.4 million at February 24, 2001. At February 23, 2002, the Company’s

limited recourse with respect to notes sold was $12.1 million.

The Company is party to synthetic leasing programs for two of its major

warehouses. At the expiration of each lease, the Company has the option

to either renew the lease if agreed to through negotiations with the applica-

ble third party, purchase the property based on a fixed purchase price as

established in the original agreement, or remit a contingent rental payment

to the applicable third party. The two synthetic leases expire in fiscal 2004

and fiscal 2005. The synthetic lease that expires in fiscal 2004 has a renewal

option available through fiscal 2009, an approximate purchase option of

$60 million or a contingent rental liability of $50 million. The synthetic lease

that expires in fiscal 2005 has a renewal option available through fiscal

2007, an approximate purchase option of $25 million or a contingent rental

liability of $20 million. At February 23, 2002, the estimated market value of

the properties underlying these leases equals or exceeds the purchase

option and the contingent rental liability.

The Company is a party to various legal proceedings arising from the

normal course of business activities, none of which, in management’s

opinion, is expected to have a material adverse impact on the Company’s

consolidated statement of earnings or consolidated financial position.

Retirement Plans

Substantially all non-union employees of the Company and its subsidiaries

are covered by various contributory and non-contributory pension or profit

sharing plans. The Company also participates in several multi-employer

plans providing defined benefits to union employees under the provisions

of collective bargaining agreements.

Contributions under the defined contribution 401(k) and profit sharing

plans are determined at the discretion of the Board of Directors and were

$16.1, $11.9 and $14.1 million for fiscal 2002, 2001 and 2000, respectively.

Amounts charged to union pension expense were $38.4, $42.7 and

$39.3 million for fiscal 2002, 2001 and 2000, respectively.

Benefit calculations for the Company’s defined benefit pension plans are

based on years of service and the participants’ highest compensation dur-

ing five consecutive years of employment. Annual payments to the pension

trust fund are determined in compliance with the Employee Retirement

Income Security Act (ERISA). Plan assets are held in trust and invested in

separately managed accounts and publicly traded mutual funds holding

both equity and fixed income securities.

In addition to providing pension benefits, the Company provides certain

health care and life insurance benefits for certain retired employees. Certain

employees become eligible for these benefits upon meeting certain age

and service requirements.

31