Albertsons 2002 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2002 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company has entered into revolving credit agreements with various

financial institutions, which are available for general corporate purposes

and for the issuance of letters of credit. A $400 million revolving credit

agreement expires in October 2002 and a $300 million 364-day agree-

ment expires in August 2002. Both credit facilities have rates tied to

LIBOR plus 0.650 to 1.400 percent, based on the Company’s credit ratings.

Outstanding borrowings under the revolving credit facilities for February 23,

2002 and February 24, 2001 were $0 and $250 million, respectively, and

are reflected in Notes Payable on the consolidated balance sheet. As of

February 23, 2002, letters of credit under the facilities were $122 and the

unused available credit under these facilities was $578 million.

Leases

Capital and operating leases The Company leases certain retail food

stores, food distribution warehouses and office facilities. Many of these

leases include renewal options, and to a limited extent, include options to

purchase. Amortization of assets under capital leases was $31.6, $33.3

and $27.0 million in fiscal 2002, 2001 and 2000, respectively.

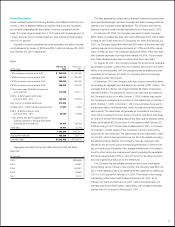

Future minimum obligations under capital leases in effect at February 23,

2002 are as follows:

(In thousands) Lease

Fiscal Year Obligations

2003 $ 64,265

2004 63,251

2005 62,872

2006 61,877

2007 62,196

Later 618,941

Total future minimum obligations 933,402

Less interest 443,226

Present value of net future minimum obligations 490,176

Less current obligations 23,062

Long-term obligations $467,114

The present values of future minimum obligations shown are calculated

based on interest rates ranging from 6.7 percent to 13.8 percent, with a

weighted average rate of 8.3 percent, determined to be applicable at the

inception of the leases.

In addition to its capital leases, the Company is obligated under operat-

ing leases, primarily for buildings, warehouses and computer equipment.

Future minimum obligations under operating leases in effect at February 23,

2002 are as follows:

(In thousands) Lease

Fiscal Year Obligations

2003 $136,826

2004 122,144

2005 106,220

2006 91,884

2007 81,985

Later 457,669

Total future minimum obligations $996,728

The Company is party to synthetic leasing programs for two of its major

warehouses. The leases qualify for operating lease accounting treatment

under SFAS No. 13, “Accounting for Leases”. For additional information on

synthetic leases, refer to the footnote on Commitments, Contingencies and

Off-Balance Sheet Arrangements.

Total rent expense, net of sublease income, relating to all operating

leases with terms greater than one year was $100.7, $88.4 and $61.5 million

in fiscal 2002, 2001 and 2000, respectively.

Future minimum receivables under operating leases and subleases in

effect at February 23, 2002 are as follows:

(In thousands) Owned Leased

Fiscal Year Property Property Total

2003 $ 2,893 $20,110 $ 23,003

2004 2,714 16,523 19,237

2005 2,620 13,815 16,435

2006 2,338 10,705 13,043

2007 2,158 8,459 10,617

Later 10,703 27,626 38,329

Total future minimum receivables $23,426 $97,238 $120,664

Owned property under operating leases is as follows:

February 23, February 24,

(In thousands) 2002 2001

Land, buildings and equipment $42,343 $44,946

Less accumulated depreciation 19,435 20,911

Net land, buildings and equipment $22,908 $24,035

28