Albertsons 2002 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2002 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The term of each option will be determined by the Board of Directors or the

Committee, but shall not be for more than 10 years from the date of grant.

Options may be exercised in installments or otherwise, as the Board of

Directors or the Committee, may determine.

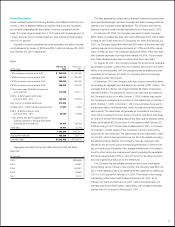

Changes in the options are as follows:

Weighted

Shares Average

(In thousands) Price per Share

Outstanding, February 27, 1999 7,916 $18.26

Richfood acquisition 1,030 24.30

Granted 3,458 28.73

Exercised (562) 14.76

Canceled and forfeited (100)

Outstanding, February 26, 2000 11,742 $22.01

Granted 4,243 15.15

Exercised (509) 15.72

Canceled and forfeited (1,066)

Outstanding, February 24, 2001 14,410 $20.26

Granted 1,215 17.32

Exercised (1,781) 15.82

Canceled and forfeited (677)

Outstanding, February 23, 2002 13,167 $20.69

The outstanding stock options at February 23, 2002 have exercise

prices ranging from $6.93 to $40.00 and a weighted average remaining

contractual life of 6.28 years. Options to purchase 8.3 and 8.2 million

shares were exercisable at February 23, 2002 and February 24, 2001,

respectively. These options have a weighted average exercise price of

$19.11 and $18.61, respectively. Option shares available for grant were 1.9

and 2.4 million at February 23, 2002 and February 24, 2001, respectively.

The Company has reserved 15.1 million shares, in aggregate, for the plans.

As of February 23, 2002, limited stock appreciation rights have been

granted and are outstanding under the 1978, 1989 and 1993 Stock

Appreciation Rights Plans. Such rights relate to options granted to pur-

chase 2.9 million shares of common stock and are exercisable only upon a

“change in control.”

No compensation cost has been recognized for options issued under

the stock option plans because the exercise price of all options granted

was not less than 100 percent of fair market value of the common stock on

the date of grant. Had compensation cost for the stock options issued

been determined based on the fair value at the grant date, consistent with

provisions of SFAS No. 123, “Accounting for Stock Based Compensation,”

the Company’s 2002, 2001 and 2000 net earnings and earnings per share

would have been changed to the pro forma amounts indicated below

(In thousands, except per share amounts) 2002 2001 2000

Net earnings

As reported $205,535 $81,965 $242,941

Pro forma 200,034 74,071 237,381

Earnings per share – diluted

As reported $ 1.53 $ 0.62 $ 1.87

Pro forma 1.49 0.56 1.82

The fair value of each option grant is estimated on the date of grant

using the Black-Scholes option pricing model with the following weighted-

average assumptions and results:

Assumptions 2002 2001 2000

Dividend yield 2.00% 2.00% 2.00%

Risk free interest rate 4.23% 4.83% 6.57%

Expected life 4.5 years 5 years 5 years

Expected volatility 32.50% 30.40% 21.97%

Estimated fair value of options

granted per share $4.85 $4.37 $6.20

Treasury Stock Purchase Program

In August 1996, the Board of Directors authorized a treasury stock pur-

chase program under which the Company is authorized to repurchase up

to 10.0 million shares for reissuance upon the exercise of employee stock

options and for other compensation programs utilizing the Company’s

stock. In December 1999, the Board of Directors authorized a treasury

stock purchase program under which the Company is authorized to pur-

chase up to $140.0 million of the Company’s common stock. In fiscal

2000, the Company repurchased 0.8 million shares at an average cost of

$22.66 under the August 1996 program and 5.9 million shares at an aver-

age cost of $17.86 under the December 1999 program. In fiscal 2001,

the Company repurchased an additional 0.8 million shares under the

August 1996 program at an average cost of $15.92 per share. In fiscal

2001, the Company completed the December 1999 program with the

repurchase of an additional 2.1 million shares at an average cost of $16.86

per share for a total cost of $140.0 million. In fiscal 2002, the Company

completed the 1996 stock repurchase program by purchasing 0.2 million

shares at an average cost of $19.97 per share. In fiscal 2002, the Board of

Directors authorized a treasury stock purchase program under which the

30