Albertsons 2002 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2002 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dividend payment dates are on or about the 15th day of March, June,

September and December, subject to the Board of Directors approval.

New Accounting Standards

In June 2001, the Financial Accounting Standards Board (FASB) approved

Statement of Financial Accounting Standard (SFAS) No. 141, “Business

Combinations” and SFAS No. 142, “Goodwill and Other Intangible Assets.”

SFAS No. 141 requires that all business combinations initiated after June

30, 2001 be accounted for under the purchase method and addresses the

initial recognition and measurement of goodwill and other intangible assets

acquired in a business combination. SFAS No. 142 requires companies to

cease amortizing goodwill that existed at June 30, 2001. For the Company,

this amortization of existing goodwill will cease on February 24, 2002.

SFAS No. 142 also establishes a new method of testing goodwill for

impairment on an annual basis or on an interim basis if an event occurs or

circumstances change that would reduce the fair value of a reporting unit

below its carrying value. The adoption of SFAS No. 142 will result in the

discontinuation of amortization of goodwill and goodwill will be tested for

impairment under the new standard beginning in the first quarter of fiscal

2003. The Company has determined that discontinuing the amortization

of goodwill will have a $0.35 per diluted share impact on earnings per

share. The Company is currently measuring the impact of goodwill impair-

ment and will complete this evaluation by the end of the first quarter of

fiscal 2003.

In June 2001, the FASB issued SFAS No. 143, “Accounting for Asset

Retirement Obligations,” which addresses financial accounting and report-

ing for obligations associated with the retirement of tangible long-lived

assets and the associated asset retirement costs. The Company plans

to adopt the provisions of SFAS No. 143 in the first quarter of fiscal 2004.

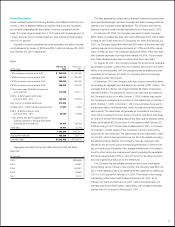

Common Stock Price

SUPERVALU’s common stock is listed on the New York Stock Exchange under the symbol SVU. At fiscal 2002 year end, there were 7,155 shareholders of

record compared with 7,243 at the end of fiscal 2001.

Common Stock Price Range Dividends Per Share

Fiscal 2002 2001 2002 2001

High Low High Low

First Quarter $16.46 $12.60 $22.88 $14.00 $0.1375 $0.1350

Second Quarter 21.80 15.00 20.25 14.69 0.1400 0.1375

Third Quarter 24.10 18.81 18.19 14.00 0.1400 0.1375

Fourth Quarter 24.96 18.85 17.81 11.75 0.1400 0.1375

Year $24.96 $12.60 $22.88 $11.75 $0.5575 $0.5475

In August 2001, the FASB approved SFAS No. 144, “Accounting for the

Impairment or Disposal of Long-Lived Assets.” The Company plans to

adopt the provisions of SFAS No. 144 in the first quarter of fiscal 2003.

The Company is currently analyzing the effect SFAS No. 143 and SFAS

No. 144 will have on its consolidated financial statements.

Quantitative And Qualitative Disclosures About Market Risk

SUPERVALU is exposed to market pricing risk consisting of interest rate risk

related to debt obligations outstanding, its investment in notes receivable

and, from time to time, derivatives employed to hedge interest rate changes

on variable and fixed rate debt. The Company does not use financial

instruments or derivatives for any trading or other speculative purposes.

SUPERVALU manages interest rate risk through the strategic use of

fixed and variable rate debt and, to a limited extent, derivative financial

instruments. Variable interest rate debt (commercial paper, bank loans,

industrial revenue bonds and other variable interest rate debt) is utilized to

help maintain liquidity and finance business operations. Long-term debt

with fixed interest rates is used to assist in managing debt maturities and

to diversify sources of debt capital.

SUPERVALU carries notes receivable because, in the normal course of

business, the Company makes long-term loans to certain retail customers

(see “Notes Receivable” in the Notes to the Consolidated Financial

Statements for further information). The notes generally bear fixed interest

rates negotiated with each retail customer. The market value of the fixed

rate notes is subject to change due to fluctuations in market interest rates.

At February 23, 2002, the estimated fair value of notes receivable approxi-

mates the net carrying value.

17