Albertsons 2002 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2002 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

actuarial assumptions used by the Company may differ materially from

actual results due to changing market and economic conditions, higher

or lower withdrawal rates, and longer or shorter life spans of participants.

Financial Instruments The Company has only limited involvement with

derivative financial instruments and uses them only to manage well-defined

interest rate risks. The derivatives used have included interest rate caps,

collars and swap agreements. The Company does not use financial instru-

ments or derivatives for any trading or other speculative purposes. At fiscal

year end 2001, the Company had two interest rate swap agreements in

place which either exchanged a floating rate payment obligation for a fixed

rate payment obligation, or exchanged a fixed rate payment obligation for a

floating rate payment obligation.

SFAS No. 133, “Accounting for Derivative Instruments and Hedging

Activities,” became effective for the Company on February 25, 2001. At

that date, the Company’s interest rate swap agreements were recorded on

its balance sheet at fair value, resulting in recognition of a liability of $23.5

million, a non-current asset of $10.8 million, a debit to other comprehensive

loss of $7.7 million, and a deferred tax liability of $5.0 million. On July 6,

2001, the swaps were terminated, which had no material impact to the

Company’s consolidated financial statements.

Fair Value Disclosures of Financial Instruments The estimated fair

value of notes receivable approximates the net carrying value at February

23, 2002 and February 24, 2001. Notes receivable are valued based on

comparisons to publicly traded debt instruments of similar credit quality.

The estimated fair market value of the Company’s long-term debt

(including current maturities) was in excess of the carrying value by approx-

imately $64.0 million at February 23, 2002, and was less than the carrying

value by approximately $43.3 million at February 24, 2001. The estimated

fair value was based on market quotes, where available, discounted cash

flows and market yields for similar instruments. The estimated fair market

value of the Company’s commercial paper and bank borrowings outstand-

ing as of February 24, 2001 approximated the carrying value.

Advertising Costs Advertising costs are expensed as incurred.

Stock-based Compensation The Company uses the “intrinsic value-

based method” for measuring the cost of compensation paid in Company

common stock. This method defines the Company’s cost as the excess of

the stock’s market value at the time of the grant over the amount that the

employee is required to pay.

Net Earnings Per Share Basic earnings per share (EPS) is calculated

using income available to common shareholders divided by the weighted

average of common shares outstanding during the year. Diluted EPS is

similar to Basic EPS except that the weighted average of common shares

outstanding is increased to include the number of additional common

shares that would have been outstanding if the dilutive potential common

shares, such as options, had been exercised.

Use of Estimates The preparation of consolidated financial statements in

conformity with accounting principles generally accepted in the United

States of America requires management to make estimates and assump-

tions that affect the reported amounts of assets and liabilities and disclo-

sure of contingent assets and liabilities at the date of the financial state-

ments and the reported amounts of revenues and expenses during the

reporting period. Actual results could differ from those estimates.

Reclassifications Certain reclassifications have been made to the prior

year’s financial statements to conform to the fiscal 2002 presentation. These

reclassifications did not affect results of operations previously reported.

Richfood Acquisition

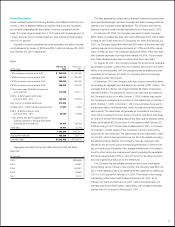

On August 31, 1999, the Company acquired, in a merger, all of the out-

standing common stock of Richfood Holdings, Inc. (Richfood), a major

food retailer and distributor operating primarily in the Mid-Atlantic region of

the United States. The acquisition was accounted for as a purchase. The

Company issued approximately 19.7 million shares of SUPERVALU com-

mon stock with a market value of approximately $443 million, paid $443

million in cash for the common stock of Richfood and assumed approxi-

mately $685 million of debt in conjunction with the acquisition. In addition,

the Company repaid approximately $394 million of outstanding Richfood

debt, leaving approximately $291 million outstanding immediately after the

acquisition. The allocation of the consideration paid for Richfood to the

consolidated assets and liabilities is based on estimates of their respective

fair values. The excess of the purchase price over the fair value of net

assets acquired of approximately $1.1 billion is being amortized on a

straight-line basis over 40 years. Beginning in fiscal 2003, goodwill will no

longer be amortized and will instead be periodically evaluated for impair-

ment. The results of Richfood’s operations since August 31, 1999 have

been included in the Company’s consolidated financial statements.

Unaudited pro forma consolidated results of continuing operations, as

though the companies had been combined at the beginning of the periods

presented, are as follows:

(In thousands, except per share data) 2000

Net sales $22,309,061

Net earnings $ 261,406 (a)

Net earnings per common share – diluted $ 1.87(a)

(a) Amounts include a net gain of $10.9 million or $0.08 per diluted share from the gain on

the sale of Hazelwood Farms Bakeries and from restructure charges.

25