Albertsons 2002 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2002 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

Notes Receivable

Notes receivable arise from financing activities with affiliated retail food cus-

tomers. Loans to affiliated retailers, as well as trade accounts receivable,

are primarily collateralized by the retailers’ inventory, equipment and fix-

tures. The notes range in length from 1 to 20 years with an average term of

7 years, and may be non-interest bearing or bear interest at rates ranging

from 5 to 11 percent.

Included in current receivables are notes receivable due within one year,

net of allowance for losses, of $23.9 and $25.1 million at February 23, 2002

and February 24, 2001, respectively

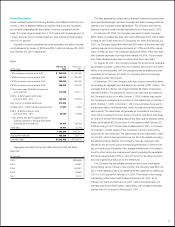

Debt

February 23, February 24,

(in thousands) 2002 2001

7.8% promissory note due fiscal 2003 $ 300,000 $ 300,000

7.625% promissory note due fiscal 2005 250,000 250,000

7.875% promissory note due fiscal 2010 350,000 350,000

8.875% promissory note due fiscal 2023 100,000 100,000

9.75% senior notes, $168,850 face amount

due fiscal 2005 174,098 178,111

6.23% – 6.69% medium-term notes

due fiscal 2006 – 2007 103,500 103,500

Zero-coupon convertible debentures 216,345 —

Variable rate to 7.125% industrial revenue bonds 71,530 74,526

8.28% – 9.96% promissory notes

due fiscal 2004 – 2010 32,420 37,648

7.78%, 8.02%, and 8.57% obligations with

quarterly payments of principal and interest

due fiscal 2005 through 2007 59,845 60,000

Other debt 10,956 13,762

1,668,694 1,467,547

Less current maturities 326,266 23,171

Long-term debt $1,342,428 $1,444,376

Aggregate maturities of long-term debt during the next five fiscal

years are:

(In thousands)

2003 $326,266

2004 31,857

2005 440,297

2006 62,826

2007 73,112

The debt agreements contain various financial covenants including max-

imum permitted leverage, minimum coverage and asset coverage ratios as

defined in the Company’s debt agreements. The Company has met the

financial covenants under the debt agreements as of February 23, 2002.

On February 28, 2000, the Company exercised its option to prepay

$88.5 million of variable rate debt. Also during fiscal year 2001, $57.5 million

in medium term notes matured. On December 26, 2000 and February 23,

2001, the Company issued $40 million and $20 million of five year debt with

quarterly payments of principal and interest at 7.78% and 8.02%, respec-

tively. On May 30, 2001, the Company issued $10 million of five-year debt

with quarterly payments of principal and interest at 8.57%. The proceeds

from these issuances were used to reduce other short-term debt.

On August 16, 2001, the Company entered into an accounts receivable

securitization program, under which the Company can borrow up to $200

million on a revolving basis, with borrowings secured by eligible accounts

receivable. As of February 23, 2002, the Company had no borrowings

outstanding under this program.

In November 2001, the Company sold zero-coupon convertible deben-

tures having an aggregate principal amount at maturity of $811 million. The

proceeds from the offering, net of approximately $5 million of expenses,

were $208 million. The debentures mature in 30 years and are callable at

the Company’s option on or after October 1, 2006. Holders may require

the Company to purchase all or a portion of their debentures on October 1,

2003, October 1, 2006, or October 1, 2011 at a purchase price equal to

the accreted value of the debentures, which includes accrued and unpaid

cash interest. The debentures will generally be convertible if the closing

price of the Company’s common stock on the New York Stock Exchange

for twenty of the last thirty trading days of any fiscal quarter exceeds certain

levels, set initially at $33.20 per share for the quarter ended February 23,

2002 and rising to $113.29 per share at September 6, 2031. In the event

of conversion, 9.6434 shares of the Company’s common stock will be

issued per $1,000 debenture. The debentures have an initial yield to matu-

rity of 4.5%, which is being accreted over the life of the debentures using

the effective interest method. The Company may pay contingent cash

interest for the six-month period commencing November 3, 2006 and for

any six-month period thereafter if the average market price of the deben-

tures for a five trading day measurement period preceding the applicable

six-month period equals 120% or more of the sum of the issue price and

accrued original issue discount for the debentures.

The Company has periodically entered into short-term credit agree-

ments having tenors of three to nine months. The Company had $215 mil-

lion in credit facilities under such agreements with rates tied to LIBOR plus

0.310 to 0.515 percent at February 24, 2001. There were no borrowings

outstanding under these credit facilities at February 24, 2001. As of

February 23, 2002 and February 24, 2001, total commercial paper out-

standing was $0 and $327 million, respectively, with a weighted average

interest rate of 6.4 percent at February 24, 2001.