Tesco 2013 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2013 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88 Tesco PLC Annual Report and Financial Statements 2013

Notes to the Group financial statements

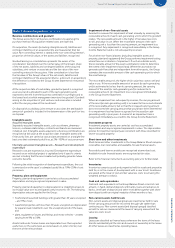

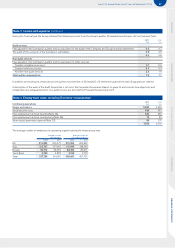

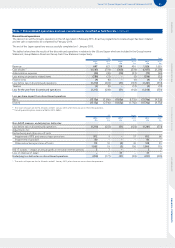

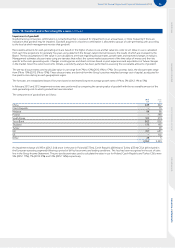

Note 5 Finance income and costs

Continuing operations 2013

£m

2012

£m

Finance income

Bank interest receivable and similar income on cash and cash equivalents 125 114

Net pension finance income (Note 26) 52 18

IAS 32 and IAS 39 ‘Financial Instruments’ – fair value remeasurements – 44

Total finance income 177 176

Finance costs

Interest payable on short-term bank loans and overdrafts repayable within five years (88) (57)

Finance charges payable under finance leases and hire purchase contracts (10) (10)

GBP MTN (219) (226)

EUR MTN (157) (180)

USD MTN (88) (67)

Other MTNs (6) (11)

Capitalised Interest (Note 11) 123 140

IAS 32 & IAS 39 ‘Financial Instruments’ – fair value remeasurements (14) –

Total finance costs (459) (411)

GBP MTNs

Interest payable on the 4% RPI GBP MTN 2016 includes £8m (2012: £13m) of Retail Price Index (‘RPI’) related amortisation.

Interest payable on the 3.322% LPI GBP MTN 2025 includes £9m (2012: £13m) of RPI related amortisation.

Interest payable on the 1.982% RPI GBP MTN 2036 includes £7m (2012: £11m) of RPI related amortisation.

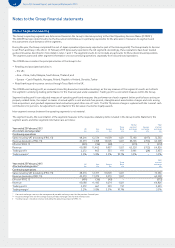

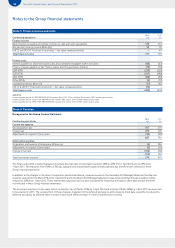

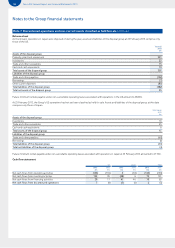

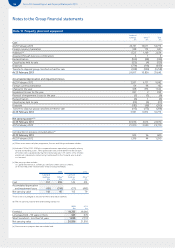

Note 6 Taxation

Recognised in the Group Income Statement

Continuing operations 2013

£m

2012

£m

Current tax expense

UK corporation tax 507 579

Foreign tax 279 195

Adjustments in respect of prior years (99) (42)

687 732

Deferred tax expense

Origination and reversal of temporary differences (6) 226

Adjustments in respect of prior years (5) (12)

Change in tax rate (102) (72)

(113) 142

Total income tax expense 574 874

The Finance Act 2012 included legislation to reduce the main rate of corporation tax from 26% to 24% from 1 April 2012 and to 23% from

1 April 2013. The reduction from 24% to 23% was substantively enacted at the balance sheet date and has therefore been reflected in these

Group financial statements.

In addition to the changes in the rates of corporation tax disclosed above, it was announced in the December 2012 Budget Statement that the rate

would be reduced from 23% to 21% from 1 April 2014 and in the March 2013 Budget Statement it was announced that the rate would be further

reduced to 20% from 1 April 2015. These further rate reductions had not been substantively enacted at the balance sheet date and are therefore

not reflected in these Group financial statements.

The proposed reductions to the main rate of corporation tax of 2% (to 21%) by 1 April 2014 and a further 1% (to 20%) by 1 April 2015 are expected

to be enacted in 2013. The overall effect of these changes, if applied to the deferred tax balance at the balance sheet date, would be to reduce the

deferred tax liability by £96m (£162m increase in profit and £66m decrease in other comprehensive income).