Tesco 2013 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2013 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

Tesco PLC Annual Report and Financial Statements 2013

OVERVIEW BUSINESS REVIEW PERFORMANCE REVIEW GOVERNANCE FINANCIAL STATEMENTS

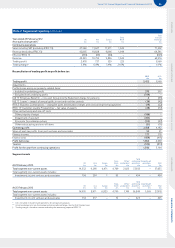

Group statement of changes in equity

All other reserves

Issued

share

capital

£m

Share

premium

£m

Other

reserves

£m

Capital

redemption

reserve

£m

Hedging

reserve

£m

Translation

reserve

£m

Treasury

shares

£m

Retained

earnings

£m

Total

£m

Non-

controlling

interests

£m

Total

equity

£m

At 25 February 2012 402 4,964 40 16 73 134 (18) 12,164 17,775 26 17, 801

Profit for the year –––––––124 124 (4) 120

Other comprehensive income

Change in fair value of available-for-sale

financial assets and investments – – – – – – – (11) (11) –(11)

Currency translation differences – – – – – 420 – – 420 –420

Reclassification adjustment on

subsidiaries disposed – – – – – 20 – – 20 –20

Actuarial losses on defined benefit

pension schemes – – – – – – – (735) (735) –(735)

Gains on cash flow hedges – – – – 21 – – – 21 –21

Tax relating to components of other

comprehensive income – – – – (3) (27) –134 104 –104

Total other comprehensive income – – – – 18 413 –(612) (181) –(181)

Total comprehensive income – – – – 18 413 –(488) (57) (4) (61)

Transactions with owners

Share-based payments – – – – – – 9 44 53 –53

Issue of shares 156 – – – – – – 57 –57

Purchase of non-controlling interests – – – – – – – 4 4 (4) –

Dividends authorised in the year – – – – – – – (1,184) (1,184) –(1,184)

Tax on items charged to equity – – – – – – – (5) (5) –(5)

Total transactions with owners 156 – – – – 9 (1,141) (1,075) (4) (1,079)

At 23 February 2013 403 5,020 40 16 91 547 (9) 10,535 16,643 18 16,661

All other reserves

Issued

share

capital

£m

Share

premium

£m

Other

reserves

£m

Capital

redemption

reserve

£m

Hedging

reserve

£m

Translation

reserve

£m

Treasury

shares

£m

Retained

earnings

£m

Total

£m

Non-

controlling

interests

£m

Total

equity

£m

At 26 February 2011 402 4,896 40 13 (1) 155 (141) 11,171 16,535 88 16,623

Profit for the year – – – – – – – 2,806 2,806 82,814

Other comprehensive income

Change in fair value of available-for-sale

financial assets and investments – – – – – – – 13 13 –13

Currency translation differences – – – – – (27) – – (27) 5(22)

Actuarial losses on defined benefit

pension schemes – – – – – – – (498) (498) –(498)

Gains on cash flow hedges – – – – 99 – – – 99 –99

Tax relating to components of other

comprehensive income – – – – (25) 6 – 92 73 –73

Total other comprehensive income – – – – 74 (21) –(393) (340) 5 (335)

Total comprehensive income – – – – 74 (21) –2,413 2,466 13 2,479

Transactions with owners

Purchase of treasury shares – – – – – – (13) –(13) –(13)

Shares purchased for cancellation (3) – – 3 – – – (290) (290) – (290)

Share-based payments 2 – – – – – 136 (13) 125 –125

Issue of shares 168 – – – – – – 69 –69

Purchase of non-controlling interests – – – – – – – 72 72 (72) –

Future purchase of non-controlling interests – – – – – – – (3) (3) –(3)

Dividends paid to non-controlling interests –––––––––(3) (3)

Dividends authorised in the year – – – – – – – (1,180) (1,180) –(1,180)

Tax on items charged to equity – – – – – – – (6) (6) –(6)

Total transactions with owners –68 – 3 – – 123 (1,420) (1,226) (75) (1,301)

At 25 February 2012 402 4,964 40 16 73 134 (18) 12,164 17,775 26 17, 801

The notes on pages 77 to 125 form part of these financial statements.