Tesco 2013 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2013 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

108 Tesco PLC Annual Report and Financial Statements 2013

Notes to the Group financial statements

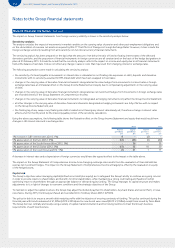

Note 22 Financial risk factors

The main financial risks faced by the Group relate to fluctuations in interest and foreign exchange rates, the risk of default by counterparties

to financial transactions and the availability of funds to meet business needs. The management of these risks is set out below.

Risk management is carried out by a central treasury department under policies approved by the Board of Directors. The Board provides written

principles for risk management, as described in the Principal risks and uncertainties on pages 38 to 42.

Interest rate risk

Interest rate risk arises from long-term borrowings. Debt issued at variable rates as well as cash deposits and short-term investments exposes

the Groupto cash flow interest rate risk. Debt issued at fixed rates exposes the Group to fair value risk. Our interest rate management policy

is explained onpage 42.

The Group has Retail Price Index (‘RPI’) debt where the principal is indexed to increases in the RPI. RPI debt is treated as floating rate debt.

The Group also has Limited Price lnflation (‘LPI’) debt, where the principal is indexed to RPI, with an annual maximum increase of 5% and

a minimum of0%. LPI debt is treated as fixed rate debt.

For interest rate risk relating to Tesco Bank, refer to the separate section on Tesco Bank financial risk factors below.

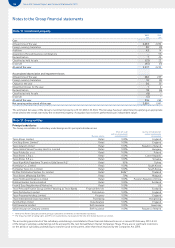

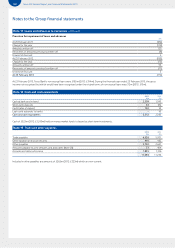

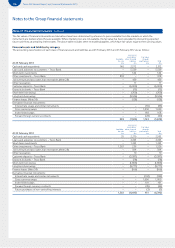

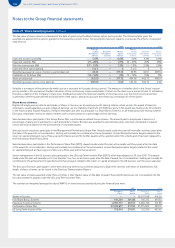

During 2013 and 2012, net debt was managed using derivative instruments to hedge interest rate risk as follows:

2013 2012

Fixed

£m

Floating

£m

Total

£m

Fixed

£m

Floating

£m

Total

£m

Cash and cash equivalents 140 2,372 2, 512 35 2,270 2,305

Loans and advances to customers – Tesco Bank 2,739 2,820 5,559 1,956 2,447 4,403

Short-term investments –522 522 – 1,243 1,243

Other investments 707 111 818 1,335 191 1,526

Joint venture and associate, loan receivables (Note 28) –459 459 – 384 384

Other receivables –17 17 – 10 10

Finance leases (Note 34) (104) (24) (128) (111) (55) (166)

Bank and other borrowings (9,569) (1,137) (10,706) (10,729) (854) (11,583)

Customer deposits – Tesco Bank (2,399) (3,601) (6,000) (1,470) (3,917) (5,387)

Deposits by banks – Tesco Bank (15) –(15) (78) – (78)

Future purchases of non-controlling interests – – – (3) – (3)

Derivative effect:

Interest rate swaps (1,156) 1,156 – (1,402) 1,402 –

Cross currency swaps 2,436 (2,436) – 2,635 (2,635) –

Index-linked swaps (537) 537 – (522) 522 –

Caps and collars – – – (1) 1 –

Total (7,758) 796 (6,962) (8,355) 1,009 (7,346)

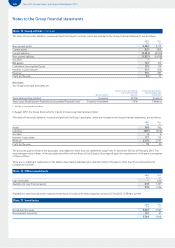

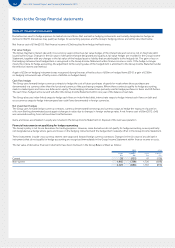

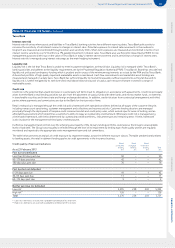

Credit risk

Credit risk arises from cash and cash equivalents, trade and other receivables, customer deposits, financial instruments and deposits with banks

and financial institutions. The Group policy on credit risk is described on page 42.

The counterparty exposure under derivative contracts is £2.0bn (2012: £1.8bn). The Group considers its maximum credit risk to be £11.9bn

(2012: £11.6bn), being the Group’s total financial assets.

For credit risk relating to Tesco Bank, refer to the separate section on Tesco Bank financial risk factors below.

Liquidity risk

Liquidity risk is managed by short-term and long-term cash flow forecasts. In addition, the Group has committed facility agreements for £2.8bn

(2012: £2.8bn), which mature between 2014 and 2015.

The Group has a European Medium Term Note programme of £15.0bn, of which £6.2bn was in issue at 23 February 2013 (2012: £7.4bn), plus

a Euro Commercial Paper programme of £2.0bn, of which £0.1bn was in issue at 23 February 2013 (2012: £nil), and a US Commercial Paper

programme of $4.0bn, of which £0.1bn was in issue at 23 February 2013 (2012: £nil).

On 12 September 2012 the Group repaid €1.5bn of long-term debt.

For liquidity risk relating to Tesco Bank, refer to the separate section on Tesco Bank financial risk factors below.