Tesco 2013 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2013 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

120 Tesco PLC Annual Report and Financial Statements 2013

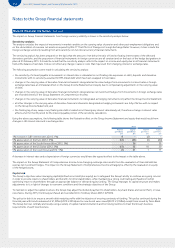

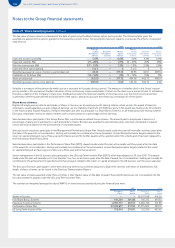

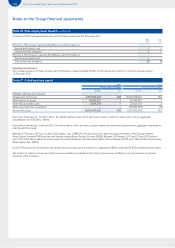

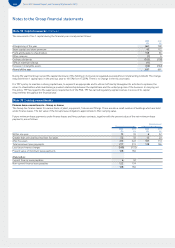

Note 26 Post-employment benefits continued

A change of 1% in assumed healthcare cost trend rates would have the following effect:

2013

£m

2012

£m

Effect of a 1% increase in assumed healthcare cost trend rates on:

Service and interest cost ––

Defined benefit obligation 22

Effect of a 1% decrease in assumed healthcare cost trend rates on:

Service and interest cost ––

Defined benefit obligation (1) (1)

Expected contributions

The Company expects to make normal cash contributions of approximately £525m to defined benefit schemes in the financial year ending

22 February 2014.

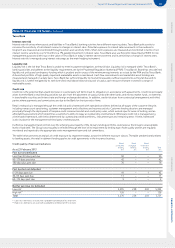

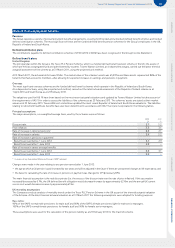

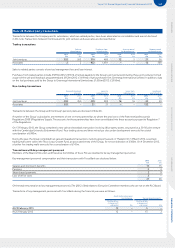

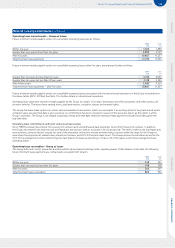

Note 27 Called up share capital

2013 2012

Ordinary shares of 5p each Ordinary shares of 5p each

Number £m Number £m

Allotted, called up and fully paid:

At beginning of the year 8,031,812,445 402 8,046,468,092 402

Share options exercises 18,632,251 123,490,825 1

Share bonus awards issues 3,610,234 –32,656, 313 2

Shares purchased for cancellation – – (70,802,785) (3)

At end of the year 8,054,054,930 403 8,031,812,445 402

During the financial year, 19 million (2012: 23 million) ordinary shares of 5p each were issued in relation to share options for an aggregate

consideration of £57m (2012: £69m).

During the financial year, 4 million (2012: 33 million) shares of 5p each were issued in relation to share bonus awards for an aggregate consideration

of £0.2m (2012: £1.6m).

Between 24 February 2013 and 12 April 2013 options over 1,288,429 ordinary shares were exercised under the terms of the Savings-related

Share Option Scheme (1981) and the Irish Savings-related Share Options Scheme (2000). Between 24 February 2013 and 12 April 2013 options

over 2,741,490 ordinary shares have been exercised under the terms of the Executive Share Option Schemes (1994 and 1996) and the Discretionary

Share Option Plan (2004).

As at 23 February 2013, the Directors were authorised to purchase up to a maximum in aggregate of 804.0 million (2012: 803.6 million) ordinary shares.

The holders of ordinary shares are entitled to receive dividends as declared from time to time and are entitled to one vote per share at general

meetings of the Company.

Notes to the Group financial statements