Tesco 2013 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2013 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

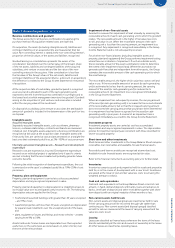

78 Tesco PLC Annual Report and Financial Statements 2013

Notes to the Group financial statements

(‘PPI’) customer redress and evidential provisions to the FCA Handbook

with an implementation date of 1 December 2010. TheGroup continues

to handle complaints and redress customers in accordance with PS

10/12. This will include ongoing analysis of historical claims experience

in accordance with the guidance.

The calculation of these provisions involves estimating a number of

variables, principally the level of customer complaints which may be

received and the level of any compensation which may be payable to

customers. The number of cases on which compensation is ultimately

payable may also be influenced by the outcome of the analysis of

historical claims referred to above. A change in the estimate of any

of the key variables in this calculation could have the potential to

significantly impact the provisions recognised.

Insurance reserves

Until October 2010 all Tesco Bank branded products were underwritten

through the RBS Insurance partner. From November 2011 all general

insurance policies sold under this arrangement had expired. A final

termination settlement agreement executed on 26 September 2012

provided a final claims reserve determination and resulted in the full

and final agreement of a concluding commission statement. The

consideration received by the Group fully satisfied any and all liabilities

of RBS Insurance (subsidiaries, affiliates and agents) to the Group.

Insurance reserves in relation to motor and insurance products sold

by the Group since October 2010 are held predominantly within Tesco

Underwriting Limited.

Post-employment benefit obligations

The present value of the post-employment benefit obligations depends

ona number of factors that are determined on an actuarial basis using

anumber of assumptions. The assumptions used in determining the

netcost (income) for pensions include the discount rate. Any changes in

these assumptions will impact the carrying amount of post-employment

benefit obligations.

Key assumptions for post-employment benefit obligations are disclosed

in Note 26.

Adoption of amended International Financial Reporting

Standards

The Group has adopted the following amended standards as of

26 February 2012.

• IFRS 7 (amended) ‘Financial instruments: disclosures’

• IAS 12 (amended) ‘Income Taxes’.

The adoption of the above amendments has not had any significant

impact on the amounts reported in the Group financial statements but

may impact the disclosure for future transactions and arrangements.

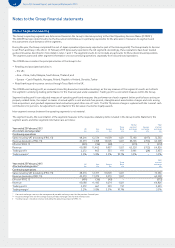

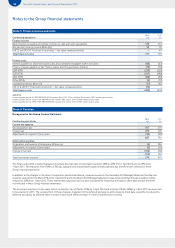

Revenue

Revenue comprises the fair value of consideration received or receivable

for the sale of goods and services in the ordinary course of the Group’s

activities.

Sale of goods

Revenue is recognised when the significant risks and rewards of ownership

of the goods have transferred to the buyer and the amount of revenue

can be measured reliably.

Revenue is recorded net of returns, discounts/offers and value added taxes.

Provision of services

Revenue from the provision of services is recognised when the service

is provided and the revenue can be measured reliably, based on the

terms of the contract.

Where the Group acts as an agent selling goods or services, only

the commission income is included within revenue.

Financial services

Revenue consists of interest, fees and income from the provision

ofinsurance.

Interest income on financial assets that are classified as loans and

receivables is determined using the effective interest rate method.

Calculation of the effective interest rate takes into account fees

receivable that are an integral part of the instrument’s yield, premiums

or discounts on acquisition or issue, early redemption fees and

transaction costs.

Fees in respect of services (credit card interchange fees, late payment

and ATM revenue) are recognised as the right to consideration accrues

through the provision of the service to the customer. The arrangements

are generally contractual and the cost of providing the service is incurred

as the service is rendered.

The Group generates commission from the sale and service of Motor

and Home insurance policies underwritten by Tesco Underwriting

Limited, or in a minority of cases by a third party underwriter. This is

based on commission rates which are independent of the profitability

of underlying insurance policies. Similar commission income is also

generated from the sale of white label insurance products underwritten

by other third party providers.

The Group continues to receive insurance commission arising from

the sale of insurance policies sold under the Tesco brand through the

legacy arrangement with RBS. This commission income is variable and

dependent upon the profitability of the underlying insurance policies.

Clubcard, loyalty and other initiatives

The cost of Clubcard and loyalty initiatives is part of the fair value of the

consideration received and is deferred and subsequently recognised over

the period that the awards are redeemed. The deferral is treated as

a deduction from revenue.

The fair value of the points awarded is determined with reference to the

fair value to the customer and considers factors such as redemption via

Clubcard deals versus money-off-in-store and redemption rate.

Tesco for Schools & Clubs vouchers are issued by Tesco for redemption

by participating schools/clubs and are part of our overall Community

Plan. The cost of the redemption (i.e. meeting the obligation attached

to the vouchers) is treated as a cost rather than a deduction from sales.

Rental income

Rental income is recognised in the period in which it is earned,

in accordance with the terms of the lease.

Finance income

Finance income, excluding income arising from financial services,

is recognised in the period to which it relates using the effective

interest ratemethod.

Finance costs

Finance costs directly attributable to the acquisition or construction

of qualifying assets are capitalised. Qualifying assets are those that

necessarily take a substantial period of time to prepare for their intended

use. All other borrowing costs are recognised in the Group Income

Statement in finance costs, excluding those arising from financial

services, in the period in which they occur. For Tesco Bank, finance

cost on financial liabilities is determined using the effective interest

rate method and is recognised in cost of sales.

Note 1 Accounting policies continued