Tesco 2013 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2013 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83

Tesco PLC Annual Report and Financial Statements 2013

OVERVIEW BUSINESS REVIEW PERFORMANCE REVIEW GOVERNANCE FINANCIAL STATEMENTS

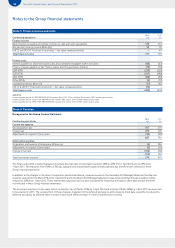

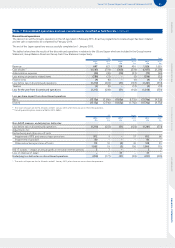

• IAS 19 ‘Employee Benefits’ – non-cash Group Income Statement

charge for pensions. Under IAS 19, the cost of providing pension

benefits in the future is discounted to a present value at the corporate

bond yield rates applicable on the last day of the previous financial

year. Corporate bond yield rates vary over time which in turn creates

volatility in the Group Income Statement and Group Balance Sheet.

IAS 19 also increases the charge for young pension schemes, such

as the Group’s, by requiring the use of rates which do not take into

account the future expected returns on the assets held in the pension

scheme which will fund pension liabilities as they fall due. The sum

of these two effects can make the IAS 19 charge disproportionately

higher and more volatile than the cash contributions the Group is

required to make in order to fund all future liabilities. Therefore,

within underlying profit the Group has included the ‘normal’ cash

contributions for pensions but excluded the volatile element of IAS 19

to represent what the Group believes to be a fairer measure of the

cost of providing post-employment benefits.

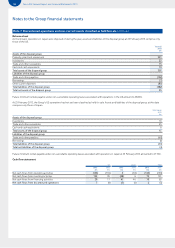

• IAS 17 ‘Leases’ – impact of annual uplifts in rent and rent-free

periods. The amount charged to the Group Income Statement in

respect of operating lease costs and incentives is expected to increase

significantly as the Group expands its international business. The

leases have been structured in a way to increase annual lease costs

as the businesses expand. IAS 17 requires the total expected cost of

a lease to be recognised on a straight-line basis over the term of the

lease, irrespective of the actual timing of the cost. This adjustment

also impacts the Group’s operating profit and rental income within

the share of post-tax profits ofjoint ventures and associates.

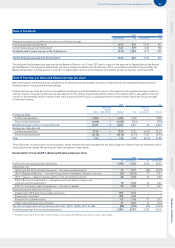

• IFRS 3 (Revised) ‘Business Combinations’ – intangible asset

amortisation charges and costs arising from acquisitions. Under

IFRS 3 intangible assets are separately identified and fair valued.

The intangible assets are required to be amortised on a straight-line

basis over their useful lives and as such is a non-cash charge that

does not reflect the underlying performance of the business acquired.

Similarly, the standard requires all acquisition costs to be expensed

in the Group Income Statement. Due to their nature, these costs

have been excluded from underlying profit as they do not reflect

the underlying performance of the Group.

• IFRIC 13 ‘Customer Loyalty Programmes’ – fair value of awards.

The interpretation requires the fair value of customer loyalty awards

to be measured as a separate component of a sales transaction.

The underlying profit measure removes this fair value allocation

to present underlying business performance, and to reflect the

performance of the operating segments as measured by

management.

• Restructuring and other one-off costs. These relate to certain costs

associated with the Group’s restructuring activities and certain

one-off costs including costs relating to fair valuing the assets of

a disposal group. These have been excluded from underlying profit

as they do not reflect the underlying performance of the Group.

Note 1 Accounting policies continued