Tesco 2013 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2013 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

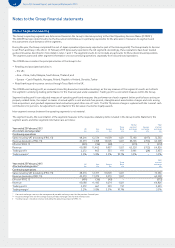

74 Tesco PLC Annual Report and Financial Statements 2013

Group balance sheet

notes

23 February

2013

£m

25 February

2012

£m

Non-current assets

Goodwill and other intangible assets 10 4,362 4,618

Property, plant and equipment 11 24,870 25,710

Investment property 12 2,001 1,991

Investments in joint ventures and associates 13 494 423

Other investments 14 818 1,526

Loans and advances to customers 17 2,465 1,901

Derivative financial instruments 21 1,965 1,726

Deferred tax assets 658 23

37,033 37,918

Current assets

Inventories 15 3,744 3,598

Trade and other receivables 16 2,525 2,657

Loans and advances to customers 17 3,094 2,502

Derivative financial instruments 21 58 41

Current tax assets 10 7

Short-term investments 522 1,243

Cash and cash equivalents 18 2,512 2,305

12,465 12,353

Assets of the disposal group and non-current assets classified as held for sale 7631 510

13,096 12,863

Current liabilities

Trade and other payables 19 (11,094) (11,234)

Financial liabilities:

Borrowings 20 (766) (1,838)

Derivative financial instruments and other liabilities 21 (121) (128)

Customer deposits and deposits by banks 23 (6,015) (5,465)

Current tax liabilities (519) (416)

Provisions 24 (188) (99)

(18,703) (19,180)

Liabilities of the disposal group classified as held for sale 7(282) (69)

Net current liabilities (5,889) (6,386)

Non-current liabilities

Financial liabilities:

Borrowings 20 (10,068) (9,911)

Derivative financial instruments and other liabilities 21 (759) (688)

Post-employment benefit obligations 26 (2,378) (1,872)

Deferred tax liabilities 6(1,006) (1,160)

Provisions 24 (272) (100)

(14,483) (13,731)

Net assets 16,661 17,801

Equity

Share capital 27 403 402

Share premium 5,020 4,964

All other reserves 685 245

Retained earnings 10,535 12,164

Equity attributable to owners of the parent 16,643 17,775

Non-controlling interests 18 26

Total equity 16,661 17,8 01

The notes on pages 77 to 125 form part of these financial statements.

Philip Clarke

Laurie McIlwee

Directors

The financial statements on pages 72 to 125 were authorised for issue by the Directors on 1 May 2013 and are subject to the approval of the

shareholders at the Annual General Meeting on 28 June 2013.