TCF Bank 2004 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2004 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

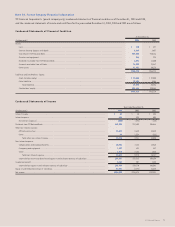

74 TCF Financial Corporation and Subsidiaries

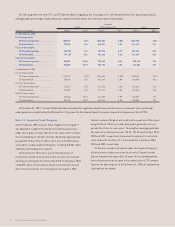

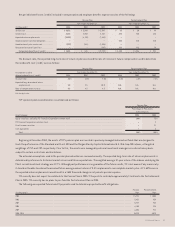

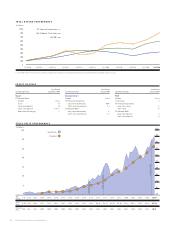

Note 25. Business Segments

Banking, leasing and equipment finance, and mortgage banking

have been identified as reportable operating segments. Banking

includes the following operating units that provide financial services

to customers: deposits and investment products, commercial lend-

ing, consumer lending, residential lending and treasury services.

Management of TCF’s banking area is organized by state. The sepa-

rate state operations have been aggregated for purposes of segment

disclosures. Leasing and equipment finance provides a broad range

of comprehensive leasing and equipment finance products address-

ing the financing needs of diverse companies. Mortgage banking

activities represent the mortgage servicing business and previously

included the origination and purchase of residential mortgage loans

primarily for sale to third parties, generally with servicing retained.

In addition, TCF operates a bank holding company (“parent company”)

and has corporate functions that provide data processing, bank

operations and other professional services to the operating segments.

TCF evaluates performance and allocates resources based on

the segments’ net income. The business segments follow generally

accepted accounting principles as described in the Summary of

Significant Accounting Policies. TCF generally accounts for inter-

segment sales and transfers at cost.

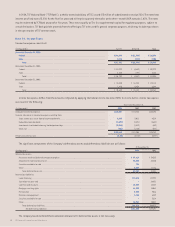

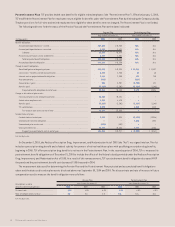

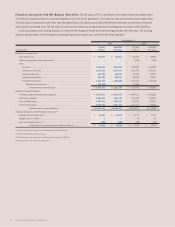

The following table sets forth certain information about the reported profit or loss and assets of each of TCF’s reportable segments, including

a reconciliation of TCF’s consolidated totals. The results of TCF’s parent company and corporate functions comprise the “other” category in the

table below.

Leasing and Eliminations

Equipment Mortgage and

(In thousands) Banking Finance Banking Other Reclassifications Consolidated

At or For the Year Ended December 31, 2004:

Revenues from external customers:

Interest income . . . . . . . . . . . . . . . . . . . . . $ 529,281 $ 89,364 $ 4,164 $ – $ – $ 622,809

Non-interest income . . . . . . . . . . . . . . . . . 426,867 50,697 12,946 (44) – 490,466

Total . . . . . . . . . . . . . . . . . . . . . . . . . . $ 956,148 $ 140,061 $ 17,110 $ (44) $ – $ 1,113,275

Net interest income . . . . . . . . . . . . . . . . . . . . . $ 427,483 $ 55,699 $ 8,204 $ (831) $ 1,336 $ 491,891

Provision for credit losses . . . . . . . . . . . . . . . . . 4,141 6,806 – – – 10,947

Non-interest income . . . . . . . . . . . . . . . . . . . . . 426,867 50,697 14,282 95,682 (97,062) 490,466

Non-interest expense . . . . . . . . . . . . . . . . . . . . 516,629 43,718 27,371 94,942 (95,726) 586,934

Income tax expense (benefit) . . . . . . . . . . . . . . 113,644 20,000 (1,727) (2,434) – 129,483

Net income (loss) . . . . . . . . . . . . . . . . . . . . $ 219,936 $ 35,872 $ (3,158) $ 2,343 $ – $ 254,993

Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . $11,903,232 $ 1,449,424 $ 76,468 $ 135,615 $(1,224,172) $12,340,567

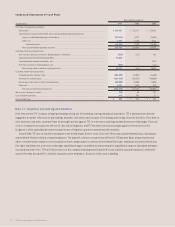

At or For the Year Ended December 31, 2003:

Revenues from external customers:

Interest income . . . . . . . . . . . . . . . . . . . . . $ 545,764 $ 81,912 $ 13,843 $ – $ – $ 641,519

Non-interest income . . . . . . . . . . . . . . . . . 355,088 51,088 12,761 342 – 419,279

Total . . . . . . . . . . . . . . . . . . . . . . . . . . $ 900,852 $ 133,000 $ 26,604 $ 342 $ – $ 1,060,798

Net interest income . . . . . . . . . . . . . . . . . . . . . $ 415,163 $ 45,358 $ 21,357 $ (1,074) $ 341 $ 481,145

Provision for credit losses . . . . . . . . . . . . . . . . . 4,361 8,171–––12,532

Non-interest income . . . . . . . . . . . . . . . . . . . . . 355,088 51,088 13,102 89,059 (89,058) 419,279

Non-interest expense . . . . . . . . . . . . . . . . . . . . 489,212 41,977 29,963 87,674 (88,717) 560,109

Income tax expense (benefit) . . . . . . . . . . . . . . 96,449 17,031 1,590 (3,165) - 111,905

Net income . . . . . . . . . . . . . . . . . . . . . . . . . $ 180,229 $ 29,267 $ 2,906 $ 3,476 $ - $ 215,878

Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 10,915,010 $ 1,216,854 $ 173,867 $ 126,478 $ (1,113,194) $11,319,015

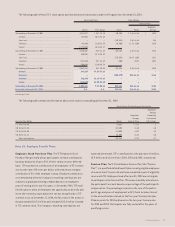

At or For the Year Ended December 31, 2002:

Revenues from external customers:

Interest income . . . . . . . . . . . . . . . . . . . . . $ 632,804 $ 85,447 $ 15,112 $ – $ – $ 733,363

Non-interest income . . . . . . . . . . . . . . . . . 359,895 51,806 6,980 1,081 – 419,762

Total . . . . . . . . . . . . . . . . . . . . . . . . . . $ 992,699 $ 137,253 $ 22,092 $ 1,081 $ – $ 1,153,125

Net interest income . . . . . . . . . . . . . . . . . . . . . $ 437,049 $ 41,374 $ 20,676 $ (1,210) $ 1,336 $ 499,225

Provision for credit losses . . . . . . . . . . . . . . . . . 12,778 9,228 – – – 22,006

Non-interest income . . . . . . . . . . . . . . . . . . . . . 359,895 51,806 8,316 95,272 (95,527) 419,762

Non-interest expense . . . . . . . . . . . . . . . . . . . . 473,467 40,983 24,796 94,233 (94,191) 539,288

Income tax expense (benefit) . . . . . . . . . . . . . . 109,959 15,497 1,511 (2,205) – 124,762

Net income . . . . . . . . . . . . . . . . . . . . . . . . . $ 200,740 $ 27,472 $ 2,685 $ 2,034 $ – $ 232,931

Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 11,784,981 $ 1,100,744 $ 447,840 $ 96,300 $ (1,227,796) $ 12,202,069