TCF Bank 2004 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2004 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42 TCF Financial Corporation and Subsidiaries

Borrowings Borrowings totaled $3.1 billion at December 31, 2004,

up $689.8 million from December 31, 2003. The increase was prima-

rily attributable to the loans and leases increasing $1 billion during

2004 while deposit balances grew only $350.5 million which increases

TCF’s reliance on borrowings. During the second quarter of 2004,

TCF National Bank, a subsidiary of TCF Financial Corporation issued

$75 million of subordinated notes due in 2014. These notes qualify

as Tier 2 or supplemental capital for regulatory purposes, subject

to certain limitations. TCF Bank paid the proceeds from the offering

to TCF to be used for general corporate purposes, which may include

repurchases in the open market of TCF common stock. See Notes 12

and 13 of Notes to Consolidated Financial Statements for detailed

information on TCF’s borrowings. Included in long-term borrowings

at December 31, 2004 are $767.5 million of fixed-rate FHLB advances

and repurchase agreements with other financial institutions which

are callable quarterly at par until maturity. If called, replacement

funding will be provided by the counterparties at the then-prevailing

short-term market rate of interest for the remaining term-to-maturity

of the advances and repurchase agreements, subject to standard

terms and conditions. The weighted-average rate on borrowings

increased to 3.37% at December 31, 2004, from 3.24% at December 31,

2003. TCF does not utilize unconsolidated subsidiaries or special

purpose entities to provide off-balance-sheet borrowings. See Note

20 of Notes to Consolidated Financial Statements for information

relating to off-balance-sheet instruments.

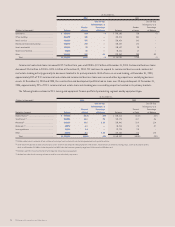

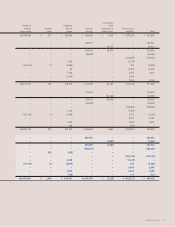

Contractual Obligations and Commitments As disclosed in the Notes to Consolidated Financial Statements, TCF has certain obligations

and commitments to make future payments under contracts. At December 31, 2004, the aggregate contractual obligations (excluding bank

deposits) and commitments are as follows:

(In thousands) Payments Due by Period

Less than 1-3 4-5 After 5

Contractual Obligations Total 1 Year Years Years Years

Total borrowings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $3,104,603 $2,277,682 $ 327,663 $ 125,049 $ 374,209

Annual rental commitments under non-cancelable

operating leases . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 170,441 23,894 40,631 33,823 72,093

Purchase obligations (construction contracts and

land purchase commitments for future branch sites) . . . . . . . . . 20,315 20,315–––

$3,295,359 $2,321,891 $ 368,294 $ 158,872 $ 446,302

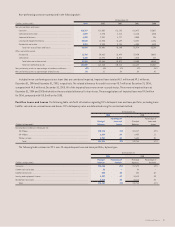

(In thousands) Amount of Commitment – Expiration by Period

Less than 1-3 4-5 After 5

Other Commitments Total 1 Year Years Years Years

Commitments to lend:

Consumer . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,576,381 $ 8,217 $ 22,311 $ 38,240 $1,507,613

Commercial . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 684,029 443,267 204,625 25,003 11,134

Leasing and equipment finance . . . . . . . . . . . . . . . . . . . . . . . . . . 72,614 72,614–––

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 55,343 55,343–––

Total commitments to lend . . . . . . . . . . . . . . . . . . . . . . . . . . 2,388,367 579,441 226,936 63,243 1,518,747

Loans serviced with recourse . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 97,568 2,288 4,772 4,329 86,179

Standby letters of credit and guarantees on industrial

revenue bonds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 75,957 46,650 18,677 10,630 –

$2,561,892 $ 628,379 $ 250,385 $ 78,202 $1,604,926