TCF Bank 2004 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2004 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2004 Annual Report 25

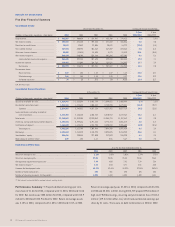

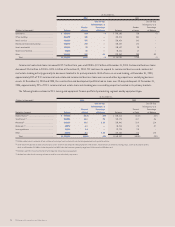

The increase in 2004 in net interest income primarily reflects the

growth in average consumer, commercial and leasing and equipment

finance balances, up $1 billion over 2003, partially offset by the

reductions in residential real estate loans and mortgage-backed

securities, down $690.3 million from 2003, and residential mortgage

loans held for sale down $179.9 million during the same period. The

decrease in average residential real estate loans and mortgage-

backed securities reflects management’s decision to delay investing

in long-term fixed-rate residential real estate loans and mortgage-

backed securities to replace prepayments and sales of such assets

during the very low interest rate environment coupled with the growth

in higher yielding consumer, commercial and lease equipment finance

loans and leases.

The decrease in 2003, from 2002, in both net interest income and

net interest margin was primarily the result of a decline in the over-

all yield on interest-earning assets during 2003, partially offset by

a decline in the overall cost of funds on interest-bearing liabilities.

The yield on interest-earning assets declined 88 basis points from

6.93% for 2002 to 6.05% for 2003, while the overall cost of funds

on interest-bearing liabilities declined 72 basis points to 1.56% for

2003. Interest income decreased $91.8 million in 2003, reflecting

decreases of $92.9 million due to the decline in rates partially

offset by a $1 million increase due to volume. Interest expense

decreased $73.8 million in 2003, reflecting decreases of $75.2 mil-

lion due to lower cost of funds, partially offset by a $1.4 million

increase due to volume.

Net interest income and net interest margin in 2002 increased

from 2001 primarily as a result of growth in average low-cost deposits

(checking, savings and money market), up $997.8 million, or 23.2%,

coupled with growth in higher-yielding loans and leases (commercial,

consumer and lease equipment finance) of $724.6 million, or 14%,

and lower borrowing costs. These increases were partially offset by

a decrease of $850 million, or 17.1%, for 2002 in lower-yielding

residential mortgages and mortgage-backed securities.

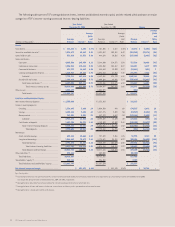

Provision for Credit Losses TCF provided $10.9 million for

credit losses in 2004, compared with $12.5 million in 2003 and $22

million in 2002. The decrease in the provision from 2003 primarily

reflects declines in net charge-offs. Net loan and lease charge-offs

were $9.5 million, or .11% of average loans and leases in 2004, down

from $12.9 million, or .16% of average loans and leases in 2003 and

$20 million, or .25% of average loans and leases in 2002. Leasing

and equipment finance net charge-offs were $5.5 million, or .43% of

related average loans and leases during 2004, down from $7.5 million,

or .69% of related average loans and leases in 2003. The determination

of the allowance for loan and lease losses and the related provision

for credit losses is a critical accounting estimate which involves a

number of factors such as net charge-offs, delinquencies in the loan

and lease portfolio, value of collateral, general economic conditions

and management’s assessment of credit risk in the current loan and

lease portfolio. Also see “Consolidated Financial Condition Analysis

– Allowance for Loan and Lease Losses.”