TCF Bank 2004 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2004 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56 TCF Financial Corporation and Subsidiaries

intrinsic value based method of accounting prescribed by Accounting

Principles Board (“APB”) Opinion No. 25, “Accounting for Stock Issued

to Employees,” as amended, for stock-based transactions through

December 31,1999. No compensation expense has been recognized

for any stock option grants made prior to 2000. Had the recognition

provisions of SFAS No. 123 been applied to the pre-2000 stock option

grants, the related pro-forma impact on net income and earnings

per share during 2003 and 2002 would have been immaterial.

Compensation expense for restricted stock is recorded as unearned

compensation in stockholders’ equity and amortized to compensa-

tion expense over the vesting periods. See Note 17 for additional

information concerning stock-based compensation.

Derivative Financial Instruments TCF utilizes derivative

financial instruments to meet the ongoing credit needs of its cus-

tomers and used derivatives to manage the market exposure of its

residential loans held for sale and its commitments to extend credit

for residential loans. Derivative financial instruments include

commitments to extend credit and forward mortgage loan sales

commitments. See Notes 19 and 20 for additional information

concerning these derivative financial instruments.

Note 2. Cash and Due from Banks

At December 31, 2004, TCF was required by Federal Reserve Board

regulations to maintain reserve balances of $70.1 million in cash

on hand or at the Federal Reserve Bank.

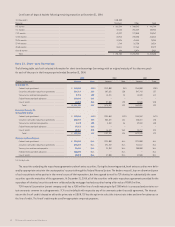

Note 3. Investments

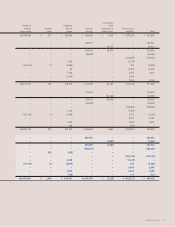

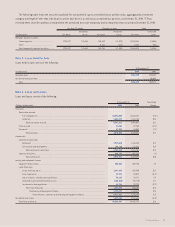

The carrying values of investments, which approximate their fair values, consist of the following:

At December 31,

(In thousands) 2004 2003

Federal Home Loan Bank stock, at cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 80,841 $ 50,411

Federal Reserve Bank stock, at cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21,865 24,045

Interest-bearing deposits with banks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 520 767

Total investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $103,226 $ 75,223

The carrying values and yields on investments at December 31, 2004, by contractual maturity, are shown below:

Carrying

(Dollars in thousands) Value Yield

Due in one year or less . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 520 1.71%

No stated maturity (1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 102,706 3.77

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $103,226 3.76

(1) Balance represents FRB and Federal Home Loan Bank (“FHLB”) stock, required regulatory investments.

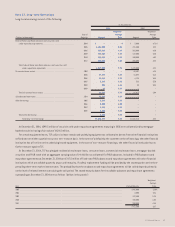

Note 4. Securities Available for Sale

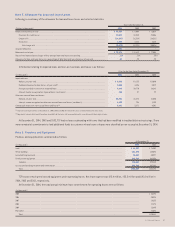

Securities available for sale consist of the following:

At December 31,

2004 2003

Gross Gross Gross Gross

Amortized Unrealized Unrealized Fair Amortized Unrealized Unrealized Fair

(Dollars in thousands) Cost Gains Losses Value Cost Gains Losses Value

Mortgage-backed securities:

Federal agencies . . . . . . . . . . . . . . . . . . . $1,614,513 $2,045 $(4,034) $1,612,524 $1,514,400 $13,744 $(4,677) $1,523,467

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,639 – (222) 6,417 9,272 – (201) 9,071

Other securities . . . . . . . . . . . . . . . . . . . . . 1,000 – – 1,000 750 – – 750

$1,622,152 $2,045 $(4,256) $1,619,941 $1,524,422 $13,744 $(4,878) $1,533,288

Weighted-average yield . . . . . . . . . . . . . . . 5.13% 5.33%

Gross gains of $22.6 million, $32.8 million and $11.5 million were recognized on sales of securities available for sale during 2004, 2003 and

2002, respectively. Mortgage-backed securities aggregating $1.4 billion and $1.3 billion were pledged as collateral to secure certain deposits

and borrowings at December 31, 2004 and 2003, respectively. See Notes 12 and 13 for additional information regarding securities pledged as

collateral to secure certain borrowings.