TCF Bank 2004 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2004 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2004 Annual Report 3

Leadership in Action

Dear Shareholders:

We are pleased to report that 2004 was a record year for TCF. Our

disciplined focus on long-term strategies for growth produced some

of the best performance ratios in the banking industry. TCF is clearly

a high performance bank.

Summarizing the year:

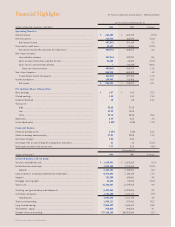

•TCF earned a record $255 million in 2004 compared to $215.9 million

in 2003. An increase of 18.1 percent.

•Diluted earnings per share (EPS) were $1.86 for 2004 compared to

$1.53 in 2003. An increase of 21.6 percent.

•TCF’s 2004 return on average assets (ROA) of 2.15 percent and

return on average equity (ROE) of 27.02 percent improved over the

previous year.

•TCF’s stock price closed at $32.14 on December 31, 2004, up 25 percent

from $25.68 per share on December 31, 2003. Our annualized total

return to investors over the past ten years was over 22 percent.

•Our dividend increased from $.65 per share in 2003 to $.75 per share

in 2004. In 2005, our dividend increased again and will be $.85 per

share. This is the fourteenth consecutive year we have increased the

dividend. We are proud that TCF has a ten-year compounded dividend

growth rate of 19.6 percent, the fifth highest dividend growth rate

among the 50 largest banks in the country.

The major factors impacting TCF’s performance in 2004 were as follows:

1. TCF’s net interest income resumed its growth in 2004. Net interest

income in 2004 was $491.9 million, up 2 percent from 2003. Most of

this improvement was due to balance sheet growth. TCF’s net inter-

est margin remained unchanged for 2004 at 4.54 percent. Short-

term interest rates rose over the year as a result of Federal Reserve

Board interest rate hikes. This rise in short-term rates helped TCF’s

net interest margin because interest rate sensitive assets exceed

variable-rate sensitive liabilities. The ten-year treasury rates

started and ended the year at about 4.25 percent. This resulted in