TCF Bank 2004 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2004 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2004 Annual Report 55

hedges using quoted market prices. See Note 19 for additional

information concerning derivative instruments and hedging activi-

ties. Net fees and costs associated with originating and acquiring

loans held for sale are deferred and are included in the basis for

determining the gain or loss on sales of loans held for sale. Gains

on sales are recorded at the settlement date and cost is determined

on a specific identification basis.

Loans and Leases Net fees and costs associated with originating

and acquiring loans and leases are deferred and amortized over

the lives of the assets. The net fees and costs for sales-type leases

are offset against revenues recorded at the commencement of

sales-type leases. Discounts and premiums on loans purchased,

net deferred fees and costs, unearned discounts and finance

charges, and unearned lease income are amortized using methods

which approximate a level yield over the estimated remaining lives

of the loans and leases.

Loans and leases, including loans that are considered to be

impaired, are reviewed regularly by management and are placed on

non-accrual status when the collection of interest or principal is 90

days or more past due (150 days or six payments or more past due for

loans secured by residential real estate), unless the loan or lease is

adequately secured and in the process of collection. When a loan or

lease is placed on non-accrual status, uncollected interest accrued

in prior years is charged off against the allowance for loan and lease

losses. Interest accrued in the current year is reversed. For those non-

accrual leases that have been funded on a non-recourse basis by

third-party financial institutions, the related debt is also placed on

non-accrual status. Interest payments received on non-accrual loans

and leases are generally applied to principal unless the remaining

principal balance has been determined to be fully collectible.

Premises and Equipment Premises and equipment, including

leasehold improvements, are carried at cost and are depreciated or

amortized on a straight-line basis over their estimated useful lives

of owned assets and for leasehold improvements over the estimated

useful life of the related asset or the lease term, whichever is shorter.

Maintenance and repairs are charged to expense as incurred.

Other Real Estate Owned Other real estate owned is recorded

at the lower of cost or fair value less estimated costs to sell at the

date of transfer to other real estate owned. At the time a loan is

transferred to other real estate owned, any carrying amount in excess

of the fair value less estimated costs to sell the property is charged

off to the allowance for loan and lease losses. Subsequently, should

the fair value of an asset less the estimated costs to sell decline to

less than the carrying amount of the asset, the deficiency is recog-

nized in the period in which it becomes known and is included in

other non-interest expense. Net operating expenses of properties

and recoveries and losses on sales of other real estate owned are

also recorded in other non-interest expense.

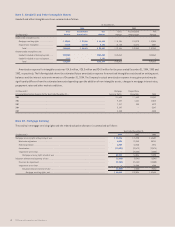

Investments in Affordable Housing Limited Partnerships

Investments in affordable housing consist of investments in limited

partnerships that operate qualified affordable housing projects or

that invest in other limited partnerships formed to operate affordable

housing projects. TCF generally utilizes the effective yield method to

account for these investments with the tax credits net of the amor-

tization of the investment reflected in the Consolidated Statements

of Income as a reduction of income tax expense. However, depending

on circumstances, the equity or cost methods may be utilized. The

amount of the investment along with any unfunded equity contri-

butions which are unconditional and legally binding are recorded

in other assets. A liability for the unfunded equity contributions is

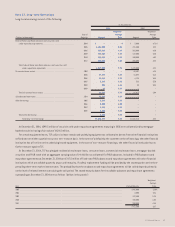

recorded in other liabilities. At December 31, 2004, TCF’s investments

in affordable housing limited partnerships were $49 million, com-

pared with $41.8 million at December 31, 2003 and were recorded

in other assets.

Four of these investments in affordable housing limited

partnerships are considered variable interest entities under the

Financial Accounting Standards Board (“FASB”) Interpretation

No. 46, “Consolidation of Variable Interest Entities” as revised

(FIN 46). These partnerships are not required to be consolidated

with TCF under FIN 46. As of December 31, 2004, the carrying

amount of these four investments, which were made in May and

October 2002, November 2003 and July 2004, was $46.7 million.

This amount included $13.9 million of unconditional unfunded

equity contributions which are recorded in other liabilities. Thus,

the maximum exposure to loss on these four investments was $46.7

million at December 31, 2004; however, the general partner of these

partnerships provides various guarantees to TCF including guaran-

teed minimum returns. These guarantees are backed by a AAA

credit-rated company and significantly limit any risk of loss.

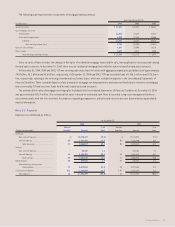

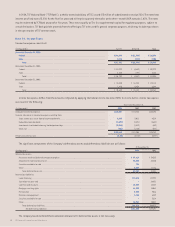

Intangible Assets On January 1, 2002, TCF adopted SFAS No.142,

“Goodwill and Other Intangible Assets,” which requires that goodwill

and intangible assets with indefinite lives no longer be amortized,

but instead tested for impairment annually. Deposit base intan-

gibles are amortized over 10 years on an accelerated basis. The

Company reviews the recoverability of the carrying values of these

assets whenever an event occurs indicating that they may be

impaired. See Note 9 for additional information concerning intan-

gible assets and goodwill.

Stock-Based Compensation TCF utilizes the recognition provi-

sions of SFAS No. 123, “Accounting for Stock-Based Compensation,”

for stock-based grants. Under SFAS No. 123, the fair value of an

option or similar equity instrument on the date of grant is amortized

to expense over the vesting period of the grant. TCF applied the