TCF Bank 2004 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2004 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

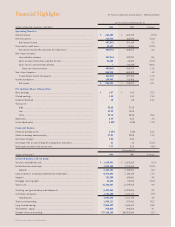

2004 Annual Report 5

0403020100

Net Income

(millions of dollars)

$186

$207

$233

$216

$255

by the 2004 acquisition of VGM Financial Services, a company spe-

cializing in home medical equipment financing. We are pleased with

this acquisition and our leasing operation results.

Average balances for TCF’s core deposits increased $249.4 million, or

4 percent. Certificates of deposit continued to decline in 2004, as other

lower cost funding sources were available to TCF. The weighted-average

interest rate on deposits at December 31, 2004 was .69 percent, one

of the lowest rates in the country. This low cost is directly attributa-

ble to our convenience banking strategy and the large amount of TCF’s

non-interest bearing deposits. We look to grow deposits faster in 2005

to fund a larger portion of TCF’s Power Asset growth.

New Branch Expansion

A good portion of TCF’s growth comes from our new branch expansion.

This strategy has provided TCF an ever-growing customer base with a

very low cost of funds.

TCF opened 30 new branches during 2004, including 19 new traditional

branches and 11 new supermarket branches. New branches opened

since 1998 now have $1.5 billion in deposits with an average interest

cost of .53 percent and 576,000 checking accounts. Checking account

growth in new branches was approximately 16 percent. Our new tradi-

tional branches are generally performing close to our expectations and

financial models. However, we have had traditional branch opening

delays due to government approval difficulties, construction delays

and poor weather, which has negatively impacted growth in new check-

ing accounts. We have continued to improve our internal capabilities

to identify and select the best sites for future growth.

During 2004, we entered into a new supermarket banking relationship

in Colorado with King Soopers®

, an affiliate of Kroger®

. We are encour-

aged by the early results.

We believe TCF’s de novo strategy is a better use of our capital than

paying the high premiums of a bank acquisition. We intend to stick to

this disciplined approach in 2005.

“TCF continued to experience

strong growth in its core

businesses in 2004.”