TCF Bank 2004 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2004 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2004 Annual Report 39

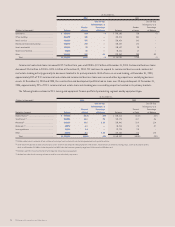

Non-performing assets are summarized in the following table:

At December 31,

(Dollars in thousands) 2004 2003 2002 2001 2000

Non-accrual loans and leases:

Consumer . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $12,187 $12,052 $11,163 $16,473 $13,027

Commercial real estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,093 2,490 3,213 11,135 5,820

Commercial business . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,533 2,931 4,777 3,550 236

Leasing and equipment finance . . . . . . . . . . . . . . . . . . . . . . . . . . 25,678 13,940 18,689 13,857 11,286

Residential real estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,387 3,993 5,798 6,959 4,829

Total non-accrual loans and leases . . . . . . . . . . . . . . . . . . . 46,878 35,406 43,640 51,974 35,198

Other real estate owned:

Residential . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11,726 20,462 16,479 12,830 10,422

Commercial . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,465 12,992 10,093 1,825 447

Total other real estate owned . . . . . . . . . . . . . . . . . . . . . . . . 17,191 33,454 26,572 14,655 10,869

Total non-performing assets . . . . . . . . . . . . . . . . . . . . . . . . $64,069 $68,860 $70,212 $66,629 $46,067

Non-performing assets as a percentage of net loans and leases . . . . .69% .83% .87% .82% .54%

Non-performing assets as a percentage of total assets . . . . . . . . . . .52 .61 .58 .59 .41

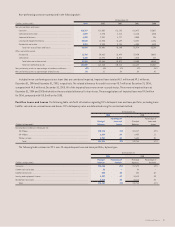

Included in non-performing assets are loans that are considered impaired. Impaired loans totaled $8.1 million and $9.1 million at

December 31, 2004 and December 31, 2003, respectively. The related allowance for credit losses was $3.7 million at December 31, 2004,

compared with $4.5 million at December 31, 2003. All of the impaired loans were on non-accrual status. There were no impaired loans at

December 31, 2004 and 2003 which did not have a related allowance for loan losses. The average balance of impaired loans was $9.8 million

for 2004, compared with $10.8 million for 2003.

Past Due Loans and Leases The following table sets forth information regarding TCF’s delinquent loan and lease portfolio, excluding loans

held for sale and non-accrual loans and leases. TCF’s delinquency rates are determined using the contractual method.

At December 31,

2004 2003

Percentage of Percentage of

Principal Loans and Principal Loans and

(Dollars in thousands) Balances Leases Balances Leases

Accruing loans and leases delinquent for:

30-59 days . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$20,776 .23% $24,187 .29%

60-89 days . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .8,659 .09 8,953 .11

90 days or more . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,950 .05 5,604 .07

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $34,385 .37% $38,744 .47%

The following table summarizes TCF’s over 30-day delinquent loan and lease portfolio, by loan type:

At December 31,

2004 2003

Principal Percentage of Principal Percentage of

(Dollars in thousands) Balances Portfolio Balances Portfolio

Consumer . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $15,436 .35 % $17,673 .49%

Commercial real estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32 – 58 –

Commercial business . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 404 .10 282 .07

Leasing and equipment finance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,997 .67 10,619 .93

Residential real estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9,516 .94 10,112 .84

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $34,385 .37% $38,744 .47%