TCF Bank 2004 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2004 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36 TCF Financial Corporation and Subsidiaries

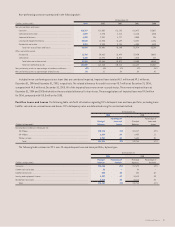

Allowance for Loan and Lease Losses Credit risk is the risk

of loss from a customer default on a loan or lease. TCF has in place a

process to identify and manage its credit risk. The process includes

initial credit review and approval, periodic monitoring to measure

compliance with credit agreements and internal credit policies,

monitoring changes in the risk ratings of loans and leases, identifi-

cation of problem loans and leases and procedures for the collection

of problem loans and leases. The risk of loss is difficult to quantify

and is subject to fluctuations in values, general economic conditions

and other factors. The determination of the allowance for loan and

lease losses is a critical accounting estimate which involves manage-

ment’s judgment on a number of factors such as net charge-offs,

delinquencies in the loan and lease portfolio, general economic con-

ditions and management’s assessment of credit risk in the current

loan and lease portfolio. The Company considers the allowance for

loan and lease losses of $79.9 million appropriate to cover losses

inherent in the loan and lease portfolios as of December 31, 2004.

However, no assurance can be given that TCF will not, in any particular

period, sustain loan and lease losses that are sizable in relation to

the amount reserved, or that subsequent evaluations of the loan and

lease portfolio, in light of factors then prevailing, including economic

conditions and TCF’s on-going credit review process, will not require

significant changes in the allowance for loan and lease losses. Among

other factors, a protracted economic slowdown and/or a decline in

commercial or residential real estate values in TCF’s markets may

have an adverse impact on the adequacy of the allowance for loan

and lease losses by increasing credit risk and the risk of potential

loss. See “Forward-Looking Information” and Notes 1 and 7 of Notes

to Consolidated Financial Statements for additional information

concerning TCF’s allowance for loan and lease losses.

The next several pages include detailed information regarding

TCF’s allowance for loan and lease losses, net charge-offs, non-

performing assets, past due loans and leases and potential problem

loans and leases. Included in this data are numerous portfolio ratios

that must be carefully reviewed and related to the nature of the

underlying loan and lease portfolios before appropriate conclusions

Total loan and lease originations and purchases for TCF’s leasing

businesses were $717.8 million at December 31, 2004, compared with

$618.3 million during 2003. The backlog of approved transactions

increased to $195.3 million at December 31, 2004, from $155.2 million

at December 31, 2003. TCF’s expanded leasing activity is subject to

risk of cyclical downturns and other adverse economic developments.

TCF’s ability to increase its leasing and equipment finance portfolio

is dependent upon its ability to place new equipment in service.

In an adverse economic environment, there may be a decline in the

demand for some types of equipment which TCF leases, resulting

in a decline in the amount of new equipment being placed into

service as well as a decline in equipment values for equipment

previously placed in service.

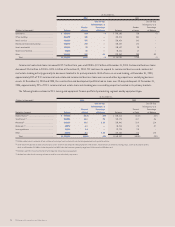

Loan and leases outstanding at December 31, 2004 are shown in the following table by maturity:

At December 31, 2004 (1)

Leasing and

Commercial Commercial Equipment Residential Total Loans

(In thousands) Consumer Real Estate Business Finance Real Estate and Leases

Amounts due:

Within 1 year . . . . . . . . . . . . . . . . . . . . . . . . $ 218,537 $ 339,974 $ 206,658 $ 548,749 $ 44,390 $1,358,308

After 1 year:

1 to 2 years . . . . . . . . . . . . . . . . . . . . . 213,561 254,168 106,279 366,559 45,976 986,543

2 to 3 years . . . . . . . . . . . . . . . . . . . . . 240,324 276,953 47,552 257,653 46,728 869,210

3 to 5 years . . . . . . . . . . . . . . . . . . . . . 451,705 498,899 33,923 250,525 83,857 1,318,909

5 to 10 years . . . . . . . . . . . . . . . . . . . . 1,105,021 703,562 17,971 56,604 197,913 2,081,071

10 to 15 years . . . . . . . . . . . . . . . . . . . 1,007,075 58,724 2,750 – 163,283 1,231,832

Over 15 years . . . . . . . . . . . . . . . . . . . . 1,181,627 24,875 8,317 – 426,873 1,641,692

Total after 1 year . . . . . . . . . . . . . . 4,199,313 1,817,181 216,792 931,341 964,630 8,129,257

Total . . . . . . . . . . . . . . . . . . . . $4,417,850 $2,157,155 $ 423,450 $1,480,090 $1,009,020 $9,487,565

Amounts due after 1 year on:

Fixed-rate loans and leases . . . . . . . . . . . . $1,678,920 $ 342,111 $ 63,161 $ 931,341 $ 743,816 $3,759,349

Variable and adjustable-rate loans(2) . . . . . 2,520,393 1,475,070 153,631 – 220,814 4,369,908

Total after 1 year . . . . . . . . . . . . . . . . . $4,199,313 $1,817,181 $ 216,792 $ 931,341 $ 964,630 $8,129,257

(1) Gross of deferred fees and costs. This table does not include the effect of prepayments, which is an important consideration in management’s interest rate risk analysis. Company experience indicates

that the loans remain outstanding for significantly shorter periods than their contractual terms.

(2) Includes $189 million of consumer loans and $13.4 million of commercial real estate and commercial business loans at their interest rate floors.