TCF Bank 2004 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2004 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

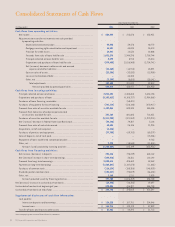

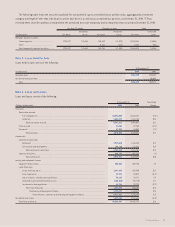

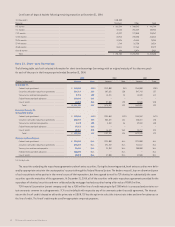

Consolidated Statements of Cash Flows

52 TCF Financial Corporation and Subsidiaries

Year Ended December 31,

(In thousands) 2004 2003 2002

Cash flows from operating activities:

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 254,993 $ 215,878 $ 232,931

Adjustments to reconcile net income to net cash provided

by operating activities:

Depreciation and amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39,996 39,478 40,772

Mortgage servicing rights amortization and impairment . . . . . . . . . . . . . 14,591 44,833 35,374

Provision for credit losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,947 12,532 22,006

Proceeds from sales of loans held for sale . . . . . . . . . . . . . . . . . . . . . . . . 1,051,276 2,944,298 2,703,744

Principal collected on loans held for sale . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,090 8,913 15,814

Originations and purchases of loans held for sale . . . . . . . . . . . . . . . . . . . (879,450) (2,816,960) (2,734,741)

Net (increase) decrease in other assets and accrued

expenses and other liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (31,265) (14,913) 43,091

Gains on sales of assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (23,306) (32,832) (13,900)

Losses on termination of debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . –44,345 –

Other, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3,299) (8,655) (20,141)

Total adjustments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 187,580 221,039 92,019

Net cash provided by operating activities . . . . . . . . . . . . . . . . . . . 442,573 436,917 324,950

Cash flows from investing activities:

Principal collected on loans and leases . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,833,653 4,343,655 3,434,153

Originations and purchases of loans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (4,183,611) (4,108,727) (2,984,568)

Purchases of lease financing receivables . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . –(58,421) –

Purchases of equipment for lease financing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (703,712) (510,140) (470,917)

Proceeds from sales of securities available for sale . . . . . . . . . . . . . . . . . . . . . . . 1,437,066 849,333 485,406

Proceeds from maturities of and principal collected

on securities available for sale . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 347,304 881,885 718,431

Purchases of securities available for sale . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,911,905) (871,559) (1,973,974)

Net (increase) decrease in Federal Home Loan Bank stock . . . . . . . . . . . . . . . . . (30,142) 79,307 3,126

Proceeds from sales of real estate owned . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40,654 26,186 21,926

Acquisitions, net of cash acquired . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (4,326) ––

Purchases of premises and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (77,788) (69,782) (60,279)

Sales of deposits, net of cash paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . –– (15,206)

Repayment of loans to deferred compensation plans . . . . . . . . . . . . . . . . . . . . . –– 9,783

Other, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,278 (18,538) (21,834)

Net cash (used) provided by investing activities . . . . . . . . . . . . . . . . . . . . . . (1,250,529) 543,199 (853,953)

Cash flows from financing activities:

Net increase (decrease) in deposits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 350,446 (98,239) 628,142

Net (decrease) increase in short-term borrowings . . . . . . . . . . . . . . . . . . . . . . . . (629,510) 36,361 122,192

Proceeds from long-term borrowings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,800,614 425,469 52,462

Payments on long-term borrowings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,505,847) (1,147,876) (11,665)

Purchases of common stock . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (116,134) (150,356) (148,030)

Dividends paid on common stock . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (104,037) (93,029) (86,430)

Other, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,168 1,211 2,029

Net cash provided (used) by financing activities . . . . . . . . . . . . . . . . . . . . . . 797,700 (1,026,459) 558,700

Net (decrease) increase in cash and due from banks . . . . . . . . . . . . . . . . . . . . . . . . . (10,256) (46,343) 29,697

Cash and due from banks at beginning of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 370,054 416,397 386,700

Cash and due from banks at end of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 359,798 $ 370,054 $ 416,397

Supplemental disclosures of cash flow information:

Cash paid for:

Interest on deposits and borrowings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 126,228 $ 157,751 $ 234,046

Income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 145,716 $ 139,120 $ 87,899

Transfer of loans and leases to other assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 23,963 $ 44,292 $ 51,713

See accompanying notes to consolidated financial statements.