TCF Bank 2004 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2004 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

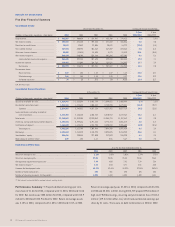

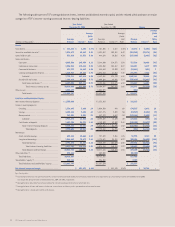

14 TCF Financial Corporation and Subsidiaries

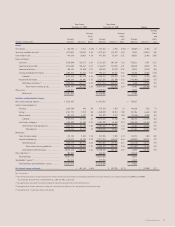

New Branch1 Total Deposits

(millions of dollars)

$190

$344

$594

$744

$1,088

$1,225

$1,503

12/0412/0312/0212/0112/0012/9912/98

1 Branches opened since January 1, 1998.

TCF’s extensive branch network is at the core of our convenience strat-

egy. Spanning six states, TCF’s 430 branches are conveniently located

where our customers live, shop and do business. We’re open seven days

a week, with extended hours in both our supermarket and traditional

branches, to ensure that our customers can do business when it’s con-

venient for them. Even on most holidays, TCF customers know that per-

sonal service is available to open new accounts, make deposits and

withdrawals, obtain loans, make investments, and have access to

other banking products and services.

Supermarket branches continue to play an important role in TCF’s con-

venience strategy. These full-service branches allow customers to sim-

plify their schedules by handling their banking needs while shopping.

During 2004, TCF began remodeling and upgrading its supermarket

branches. By the end of 2005, certain supermarket branches will have

installed new plasma-screen merchandising systems, allowing TCF to pro-

mote its products while displaying news, weather, and sports information.

TCF’s customers have also enjoyed the enhancements made to some of

our traditional branches. During 2004, we evaluated customer’s ease

of access to some of our traditional branch locations and, as a result,

moved, consolidated and remodeled targeted branches. We have also

added more traditional branch drive-through lanes, which is another

easy one-stop banking option for TCF customers. Drive-throughs will

become even more readily available as we continue to expand our

traditional branch network.

For customers who prefer the convenience of electronic banking, TCF

provides a host of products and services. These include an automated

phone system, an extensive network of TCF®EXPRESS TELLER®ATMs and

online banking products such as TCF®Totally Free Online, TCF®Preferred

Online and TCF®Online Bill Pay. During 2004, TCF’s call center opera-

tions embarked on an initiative to centralize its retail call centers and

implement a new state-of-the-art phone system simplifying phone

menu options and incorporating skill-based routing functionality for

improved customer service. Our commitment to convenience banking

was also evidenced during 2004 by enhancements to our online bill

payment service, a complete redesign of the TCFExpress.com website

and printable check images available to all online customers.

Online at TCF®Express Trade®

, customers can buy and sell stocks, mutual

funds and other securities. Access to investment holdings, account

history, stock research, and order placement are available 24 hours a

day, seven days a week, 365 days a year. Customers preferring personal

service can contact a personal trading representative.

Small business customers may also take advantage of TCF’s Internet

banking services. TCF®Totally Free Online Banking for Business provides

basic Internet banking services with no access fee. TCF®Preferred Online

Business Banking provides expanded account history and the ability

to download transaction detail into financial software applications,

helping small business owners manage their businesses.

TCF continues to expand its customer base by offering services like TCF

Check CashingSM and on-site coin counting through TCF®Express Coin

Service. New products attract new customers to TCF, such as newly

launched TCF Premier Checking PlusSM with TCF Miles PlusSM Card, TCF