Suzuki 2012 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2012 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Consolidated Financial Statements

SUZUKI MOTOR CORPORATION 55

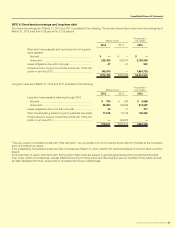

NOTE 10: Cash and cash equivalents

Cash and cash equivalents as of March 31, 2012 and 2011 consisted of:

Millions of yen

Thousands of

U.S. dollars

2012 2011 2012

Cash and deposits ............................................................ ¥291,670 ¥261,264 $3,548,731

Short-term investment securities ....................................... 542,668 484,110 6,602,615

Time deposits with maturities of over three months ......... (41,442) (46,122) (504,233)

Bonds etc. with redemption period of over three months (82,365) (67,328) (1,002,138)

¥710,530 ¥631,923 $8,644,974

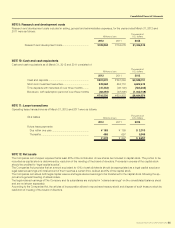

NOTE 11: Lease transactions

Operating lease transactions as of March 31, 2012 and 2011 were as follows:

As a lessee Millions of yen

Thousands of

U.S. dollars

2012 2011 2012

Future lease payments

Due within one year ....................................................... ¥ 189 ¥ 189 $ 2,310

Thereafter ....................................................................... 488 657 5,946

¥ 678 ¥ 847 $ 8,257

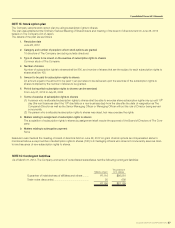

NOTE 12: Net assets

The Companies Act of Japan requires that at least 50% of the contribution of new shares be included in capital stock. The portion to be

recorded as capital stock is determined by resolution of the meeting of the board of directors. Proceeds in excess of the capital stock

should be credited to “legal capital surplus”.

The Companies Act provides that an amount equivalent to 10% of cash dividends should be appropriated as a legal capital surplus or

legal retained earnings until total amount of them reaches a certain limit, defined as 25% of the capital stock.

The Companies Act allows both legal capital reserve and legal retained earnings to be transferred to the capital stock following the ap-

proval at a general meeting of shareholders.

The legal retained earnings of The Company and its subsidiaries are included in “retained earnings” on the consolidated balance sheet

and are not shown separately.

According to the Companies Act, the articles of incorporation allows to repurchase treasury stock and dispose of such treasury stock by

resolution of meeting of the board of directors.

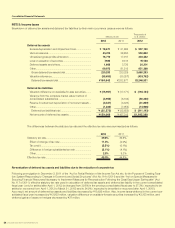

NOTE 9: Research and development costs

Research and development costs included in selling, general and administrative expenses, for the years ended March 31, 2012 and

2011 were as follows:

Millions of yen

Thousands of

U.S. dollars

2012 2011 2012

Research and development costs ........................................ ¥109,848 ¥104,079 $1,336,519