Suzuki 2012 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2012 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

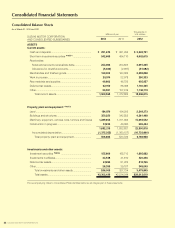

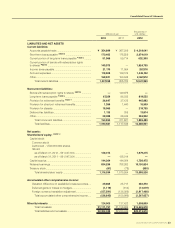

Consolidated Financial Statements

SUZUKI MOTOR CORPORATION 39

(g) Hedge accounting

Gains or losses arising from changes in fair value of the derivatives designated as “hedging instruments” are deferred as an

asset or liability and included in net profit or loss in the same period during which the gains and losses on the hedged items or

transactions are recognized.

The derivatives designated as hedging instruments by The Company and its subsidiaries are principally forward exchange

contracts and interest swaps. The related hedged items are foreign currency denominated transaction and borrowings.

The Company and its subsidiaries have a policy to utilize the above hedging instruments in order to reduce our exposure to

the risk of interest rate and foreign exchange fluctuation. Thus, our purchases of the hedging instruments are limited to, at

maximum, the amounts of the hedged items. The Company and its subsidiaries evaluate effectiveness of its hedging activities

by reference to the accumulated gains or losses on the hedging instruments and the related hedged items from the com-

mencement of the hedges.

(h) Foreign currency translation

All monetary assets and liabilities denominated in foreign currencies, whether long-term or short-term are translated into Japa-

nese yen at the exchange rates prevailing at the balance sheet date. Resulting gains and losses are included in net income or

loss for the period.

Assets and liabilities of the foreign subsidiaries and affiliates are translated into Japanese yen at the exchange rates prevailing

at the balance sheet date.

The components of net assets are translated into Japanese yen at their historical rates. Profit and loss accounts for the year

are translated into Japanese yen using the average exchange rate during the year. Differences in yen amounts arising from

the use of different rates are presented as “foreign currency translation adjustments” and “minority interests” in the net assets.

(i) Inventories

Stated at cost mainly determined by the gross average method (Figures on the consolidated balance sheet are measured by

the method of book devaluation based on the reduction of profitability)

(j) Method of depreciation and amortization of significant depreciable assets

a. Property, plant and equipment (excluding lease assets)

................. Mainly declining balance method for The Company and domestic subsidiaries and mainly straight-line

method for foreign subsidiaries

Main durable years are as follows

Buildings and structures 3 to 75 years

Machinery, equipment and vehicles 3 to 15 years

b. Intangible assets (excluding lease assets)

................. Straight line method

c. Lease assets

Finance lease which transfer ownership

................. The same method as depreciation and amortization of self-owned noncurrent assets.

Finance lease which do not transfer ownership

................. Straight-line method with the lease period as the durable years. As to lease assets with guaranteed residual

value under lease agreement, remaining value is the guaranteed residual value. And as to other lease as-

sets, remaining value would be zero.

(k) Income taxes

The provision for income taxes is computed based on the income before income taxes included in the consolidated state-

ments of income. The assets and liability approach is adopted to recognize deferred tax assets and liabilities for the expected

future tax consequences of temporary differences between the carrying amounts and the tax bases of assets and liabilities.

In making a valuation for the possibility of collection of deferred tax assets, The Company and its subsidiaries estimate their fu-

ture taxable income reasonably. If the estimated amount of future taxable income decrease, deferred tax assets may decrease

and income taxes expenses may be posted.

Consolidated tax payment has been applied since current fiscal year.