Suzuki 2012 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2012 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management policy

SUZUKI MOTOR CORPORATION 25

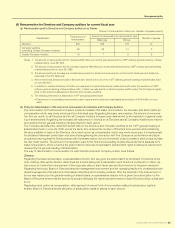

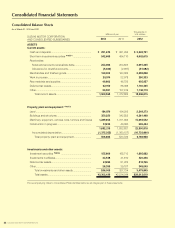

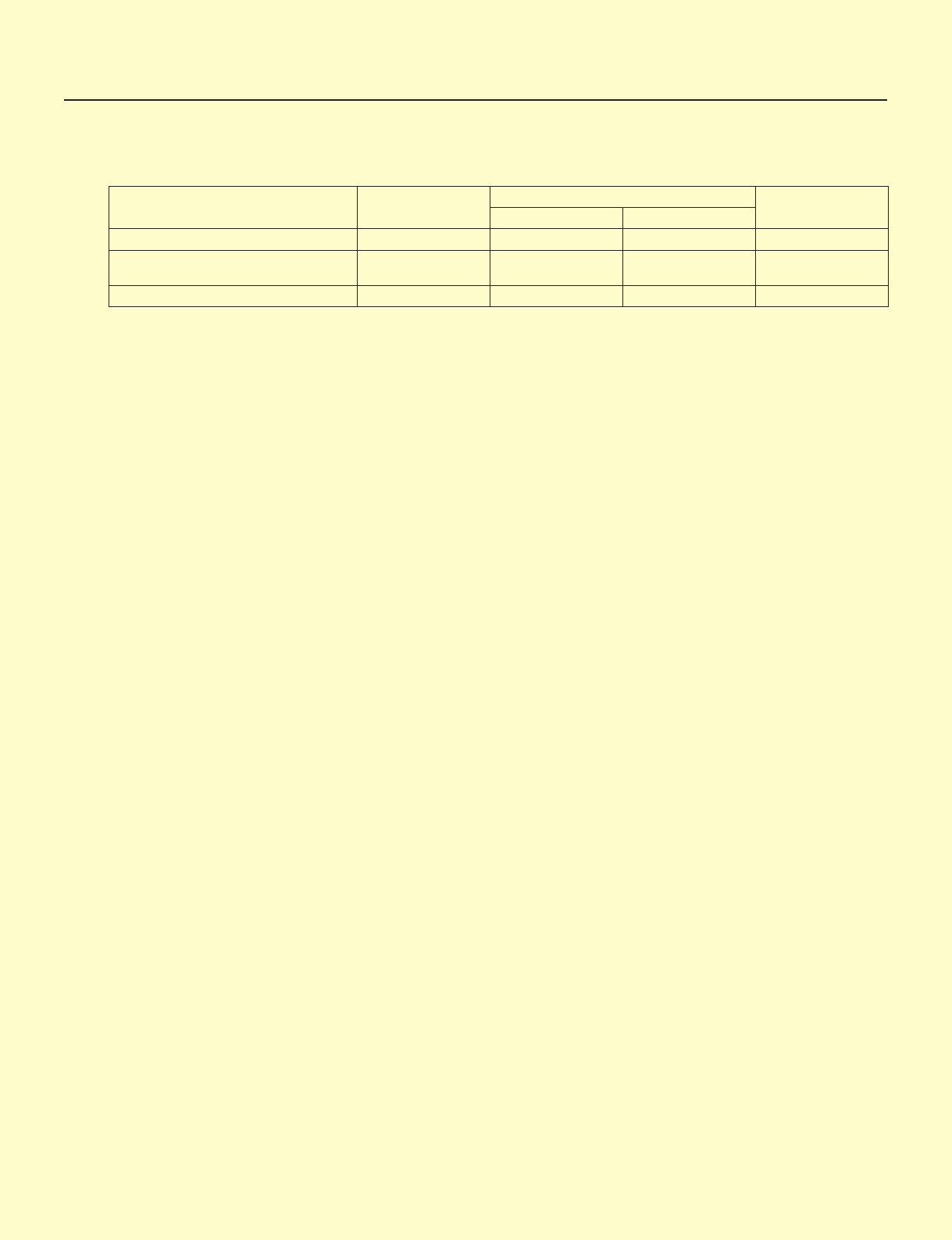

(4) Remuneration for Directors and Company auditors for current fiscal year

(a) Remuneration paid to Directors and Company auditors is as follows

(Amount of remuneration: million yen, Number of payees: person)

Classification Total amount of

remuneration

Amount of remuneration by remuneration type Number of payees

Basic pay Bonus

Directors 516 343 172 12

Company auditors

(excluding Outside Company Auditors) 48 33 14 2

Outside Company Auditors 10 7 3 3

Notes: 1. The amount of remuneration limit for directors (¥80 million per month) was resolved at the 135th ordinary general meeting of share-

holders held on June 28, 2001.

2. The amount of remuneration limit for company auditors (¥8 million per month) was resolved at the 123rd ordinary general meeting

of shareholders held on June 29, 1989.

3. The above-mentioned bonuses are recorded as provision for directors’ bonuses at the end of current fiscal year and treated as

expenses of current fiscal year.

4. Above-mentioned Directors include 2 directors who retired at the end of the 145th ordinary general meeting of shareholders held

on June 29, 2011.

5. In addition to mentioned above, 52 million yen was paid to 3 retired directors as retirement benefit under the resolution of 140th

ordinary general meeting of shareholders. Also, 1 million yen was paid to a retired company auditor under The Company’s regula-

tions on the retirement allowance of directors and company auditors.

6. The following information is disclosed in 146th annual securities report

• Total amount of consolidated remuneration paid to persons who received consolidated remuneration of ¥100 million or more

each.

(b) Policy for determination of the amount of remuneration for Directors and Company Auditors

The remuneration for Directors and Company Auditors consists of the basic remuneration, the bonuses, and stock option as

compensation which was newly introduced from this fiscal year. Regarding the basic remuneration, the amount of remunera-

tion limit per month for all Directors and for all Company Auditors is respectively determined by the resolution of general meet-

ing of shareholders. Regarding the bonuses, the total amount of bonus for all Directors and all Company Auditors are referred

and resolved by the general meeting of shareholders for each period.

The Company abolished the retirement benefit plan for the Directors and Company Auditors at the 140th general meeting of

shareholders held on June 29, 2006, and at the same time reduced the number of Directors to be elected while enhancing

the accountability of each of the Directors. As to stock option as compensation which was newly introduced, it is replacement

for abolished retirement benefit plan and aims at strengthening the connection with The Company’s performance and stock

prices and ensuring that the Directors share with the shareholders, not only the benefit of any increase in stock prices but also

the risk of any decline. The amount of remuneration paid to the Directors (excluding Outside Directors) that is separate from

basic remuneration, which would be the grant of stock option as compensation (subscription rights to shares) is referred and

resolved by the general meeting of shareholders.

The way of determination of remuneration for each Director and each Company Auditor is as follows

(Director)

Regarding the basic remuneration, a representative director who are given the authorization by the Board of Directors at the

time of taking office as the director determines the amount taking into consideration each Director’s contribution in office, du-

ties and so on toward the enhancement of the corporate value in each fiscal year and from medium to long term viewpoint.

Regarding the bonus, Board of Directors takes the management environment and the operating results into consideration and

determines agenda of the payment of bonuses to Directors and Company Auditors. After the proposal of the total amount of

bonus was resolved by the general meeting of shareholders, a representative director who is given the authorization by the

Board of Directors determines the amount to be paid reflecting the result and performance in each Director’s office, duties and

so on.

Regarding stock option as compensation, after approval of amount limit of remuneration related to subscription rights to

shares, Board of Directors decide allocation of subscription rights to shares to each director.