Suzuki 2012 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2012 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

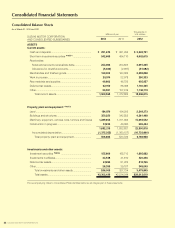

Consolidated Financial Statements

SUZUKI MOTOR CORPORATION 37

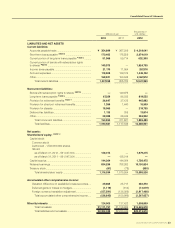

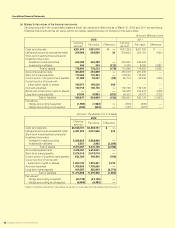

Consolidated Statements of Cash Flows

Years ended March 31, 2012 and 2011

SUZUKI MOTOR CORPORATION

AND CONSOLIDATED SUBSIDIARIES

Millions of yen

Thousands of

U.S. dollars

2012 2011 2012

Cash flows from operating activities

Income before income taxes ............................................. ¥116,751 ¥118,186 $1,420,507

Depreciation and amortization .......................................... 103,117 138,368 1,254,622

Impairment loss ................................................................. 6,030 8,513 73,366

Increase (decrease) in provision for retirement benefits .. (255) (2,114) (3,108)

Increase (decrease) in provision for disaster 18,065 —219,795

Interest and dividends income .......................................... (17,617) (15,190) (214,353)

Interest expenses .............................................................. 4,750 5,091 57,797

Equity in (earnings) losses of affiliates .............................. 67 (4,161) 816

Loss (gain) on valuation of securities ............................... 5,341 5,356 64,983

Loss (gain) on sales of investment securities ................... (9,650) (370) (117,412)

Decrease (increase) in notes and accounts receivable-trade

(58,773) 36,411 (715,094)

Decrease (increase) in inventories ................................... (21,060) (7,811) (256,247)

Increase (decrease) in notes and accounts payable-trade

97,280 (117,986) 1,183,610

Increase (decrease) in accrued expenses ...................... 6,676 23,365 81,230

Other, net ............................................................................ (9,689) 62,650 (117,895)

Subtotal 241,031 250,310 2,932,617

Interest and dividends income received .......................... 19,312 13,822 234,978

Interest expenses paid ...................................................... (4,081) (5,012) (49,665)

Income taxes paid ............................................................. (29,543) (32,650) (359,457)

Net cash provided by (used in) operating activities 226,718 226,470 2,758,473

Cash flows from investing activities

Payments into time deposits ............................................. (42,786) (88,169) (520,581)

Proceeds from withdrawal of time deposits...................... 40,875 49,791 497,328

Purchases of short-term investment securities ................ (84,628) (301,849) (1,029,669)

Proceeds from sales of short-term investment securities

59,157 386,687 719,759

Purchases of property, plant and equipment ................... (119,210) (129,732) (1,450,420)

Proceeds from sales of property, plant and equipment ... 3,751 6,823 45,638

Purchases of investment securities .................................. (2,188) (25,227) (26,633)

Proceeds from sales and redemption of investment securities

. 25,025 1,038 304,480

Payments for investments in capital ................................. (384) (431) (4,673)

Payments of loans receivable ........................................... (458) (326) (5,580)

Collection of loans receivable ........................................... 28,759 16,331 349,909

Other, net ............................................................................ (1,554) (2,314) (18,912)

Net cash provided by (used in) investing activities (93,643) (87,379) (1,139,354)

Cash flows from financing activities

Net increase (decrease) in short-term loans payable ...... (12,480) (57,077) (151,848)

Proceeds from long-term loans payable .......................... 29,948 24,616 364,377

Repayment of long-term loans payable ........................... (64,165) (38,158) (780,692)

Proceeds from issuance of new shares ............................ —6,423 —

Cash dividends paid ......................................................... (7,853) (7,266) (95,557)

Cash dividends paid to minority shareholders ................. (1,947) (3,480) (23,693)

Other, net ............................................................................ (42) (34) (512)

Net cash provided by (used in) financing activities (56,540) (74,977) (687,926)

Effect of exchange rate changes on cash and cash equivalents

2,072 (15,646) 25,214

Net increase (decrease) in cash and cash equivalents 78,607 48,466 956,406

Cash and cash equivalents at beginning of period 631,923 583,456 7,688,568

Cash and cash equivalents at end of period *NOTE 10 ¥710,530 ¥631,923 $8,644,974

The accompanying Notes to Consolidated Financial Statements are an integral part of these statements.