Suzuki 2012 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2012 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54 SUZUKI MOTOR CORPORATION

Consolidated Financial Statements

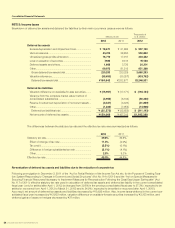

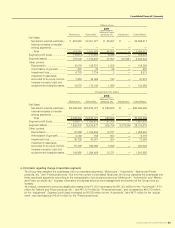

NOTE 8: Income taxes

Breakdown of deferred tax assets and deferred tax liabilities by their main occurrence causes were as follows.

Millions of yen

Thousands of

U.S. dollars

2012 2011 2012

Deferred tax assets

Excess-depreciation and Impairment loss ....................... ¥ 78,671 ¥ 81,896 $ 957,190

Various reserves ................................................................. 45,274 38,850 550,852

Unrealized gross profits elimination .................................. 16,719 17,917 203,422

Loss on valuation of securities .......................................... 7,985 9,413 97,158

Deferred assets and others ............................................... 1,668 3,736 20,301

Other ................................................................................... 69,973 81,513 851,368

Gross deferred tax assets total ....................................... 220,293 233,329 2,680,293

Valuation allowance ........................................................... (35,650) (30,357) (433,762)

Deferred tax assets total ................................................. ¥184,642 ¥202,971 $2,246,531

Deferred tax liabilities

Valuation difference on available-for-sale securities ........ ¥ (15,957) ¥ (17,171) $ (194,154)

Variance from the complete market value method of

consolidated subsidiaries ................................................. (4,952) (6,104) (60,250)

Reserve for advanced depreciation of noncurrent assets

... (3,437) (4,423) (41,829)

Other ................................................................................... (1,225) (7,955) (14,908)

Deferred tax liabilities total .............................................. ¥ (25,572) ¥ (35,655) $ (311,143)

Net amounts of deferred tax assets .................................. ¥159,069 ¥167,315 $1,935,388

The differences between the statutory tax rate and the effective tax rate were summarized as follows.

2012 2011

Statutory tax rate .................................................................... 39.8% 39.8%

Effect of change of tax rate ............................................... 11.4% (0.0%)

Tax credit ............................................................................ (5.5%) (0.1%)

Difference in foreign subsidiaries tax rate ........................ (3.1%) (4.1%)

Other ................................................................................... 2.5% 9.2%

Effective tax rate .................................................................... 45.0% 44.8%

Re-evaluation of deferred tax assets and liabilities due to the reduction of corporate tax

Following promulgation in December 2, 2011 of the “Act for Partial Revision of the Income Tax Act etc. for the Purpose of Creating Taxa-

tion System Responding to Changes in Economic and Social Structures” (Act No.114 of 2011) and the “Act on Special Measures for

Securing Financial Resources Necessary to Implement Measures for Reconstruction Following the Great East Japan Earthquake” (Act

No.117 of 2011), effective statutory tax rate used in calculation of deferred tax assets and deferred tax liability in the current consolidated

fiscal year ( only for settled after April 1, 2012) is changed from 39.8% in the previous consolidated fiscal year to 37.2% ( expected to be

settled or recovered from April 1, 2012 to March 31, 2015) and to 34.9% ( expected to be settled or recovered after April 1, 2015).

As a result, net amount of deferred tax assets and liabilities decreased by ¥10,626 million. Also, income taxes-deferred in the current con-

solidated fiscal year increased by ¥12,802 million, valuation difference on available-for-sale securities increased by ¥2,203 million, and

deferred gains or losses on hedges decreased by ¥27 million.