Suzuki 2012 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2012 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Consolidated Financial Statements

SUZUKI MOTOR CORPORATION 47

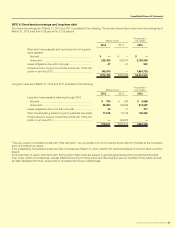

(d) Derivative transactions

The contract/notional amounts of derivatives which are shown in the below table do not represent the Group’s exposure to

market risk. As to fair values of derivatives which are shown in the below tables, commodity transactions are valued based on

market price. Other transactions are valued based on the price offered by financial institutions.

a. Derivative transactions to which hedge accounting is not applied as of March 31, 2012 and 2011

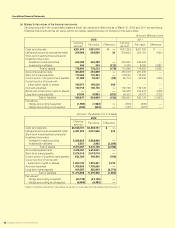

Currency related transactions (non-market transactions) (Amount: Millions of yen)

Type

2012 2011

Contract/

notional

amount

Amount

due after

one year

Fair value Gain

(loss)

Contract/

notional

amount

Amount

due after

one year

Fair value Gain

(loss)

Foreign currency

forward contracts

Selling

USD ¥ 4,383 ¥ — ¥ (46) ¥ (46) ¥ 37 ¥ — ¥ (71) ¥ (71)

EUR ————112 — (4) (4)

GBP ————135 — 5 5

Buying

USD 6,355 — 161 161 8,882 — (2) (2)

JPY 25,594 — (1,113) (1,113) 1,783 — (44) (44)

Currency swap

transactions

Receive US

Dollar and pay

Indian Rupee 2,569 — 237 237 ————

Total 38,903 — (760) (760) 10,952 — (118) (118)

(Amount: Thousands of U.S. dollars)

Type

2012

Contract/

notional

amount

Amount

due after

one year

Fair value Gain

(loss)

Foreign currency

forward contracts

Selling

USD $ 53,336 $ — $ (566) $ (566)

Buying

USD 77,324 — 1,963 1,963

JPY 311,407 — (13,546) (13,546)

Currency swap

transactions

Receive US

Dollar and pay

Indian Rupee 31,264 — 2,894 2,894

Total 473,332 — (9,256) (9,256)

Interest rate related transactions (non-market transactions) (Amount: Millions of yen)

Type

2012 2011

Contract/

notional

amount

Amount

due after

one year

Fair value Gain

(loss)

Contract/

notional

amount

Amount

due after

one year

Fair value Gain

(loss)

Interest rate swaps

Pay fixed

receive floating ————¥ 5,255 ¥ 2,627 ¥ (208) ¥ (208)

Total ————5,255 2,627 (208) (208)